The August edition of Ford Equity Research’s newsletter (click here to learn more about Ford Equity Research) was in my inbox this morning. I certainly don’t anticipate seeing their newsletter in my inbox like I anticipate seeing the SI Swimsuit edition in my mailbox, but that’s a different story.

Ford did have one interesting piece of information I wanted to pass along. We have been noticing that relative strength strategies have been, for lack of a better term, disjointed recently. What I mean is some RS formulations are doing fine right now, but others are doing very poorly. Longer term RS, which generally tests much more favorably than shorter term RS, has lagged the market by a wide margin. But some of the shorter term models are doing much better. Go figure. It’s something I can’t remember seeing to this magnitude before.

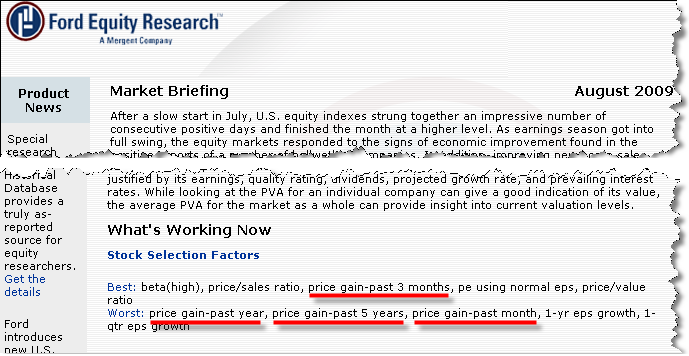

A couple of months ago I looked at the returns of different RS factors over a YTD time horizon. At that time the 1 Month RS factor was performing exceptionally well, and most of the other factors were lagging the market. We were picking up the initial stages of the laggard rally. It seems the 1 Month Factor, which has traditionally been a better mean-reversion factor than RS factor, seems to have reverted to form. Now the 3 Month Factor is performing well, but the longer term stuff is still lagging. Ford’s interpretation is in the graphic below:

In the “Best” category you find a bunch of Value factors and the 3 Month Momentum factor. In the “Worst” category you have factors on either side of the 3 Month (1 Month, 12 Month) and some growth factors. Very strange indeed.

It just goes to show how difficult it is right now to define a “strong” stock. Using different RS factors can lead to dramatically different results. We run several different types of accounts using different RS factors. This week, for example, some of the styles outperformed the market by a good margin, and others were way behind. Same philosophy, different measurement period with a dramatically different end product. I wouldn’t expect this type of thing to continue, but a disjointed market like this can leave you scratching your head sometimes.