It has been a difficult year for Relative Strength strategies. RS is a “success-based” factor, and what has worked this year has been companies that have had little success. From an RS standpoint, the laggards (those stocks that declined the most heading into the market low) have outperformed the leaders (those that held up the best in the market decline) by a historically wide margin. According to research by The Leuthold Group in their December 2009 Green Book, this year has been the second best year for laggard outperformance in history. The best year for the laggards to outperform the leaders was all the way back beginning at the market low in June 1932. Their study uses Ken French’s data, and calculates the performance spread between the leaders and laggards in the first 12 months of a new bull market.

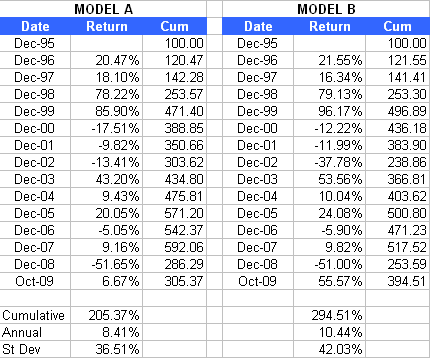

The historically high laggard outperformance presents interesting challenges for anyone who is testing and systematically applying an RS factor. Take the following two models, for example:

For purposes of this post the actual model specifications don’t matter. But for those of you who will e-mail me anyway, Model A is a simple 12-month trailing return model with 50 holdings. Very straightforward and plain vanilla. Model B is just a test I was playing around with that attempts to adapt more quickly to the market. In effect, the RS factor is a 12-month trailing return unless there is a 20% swing in the S&P 500. If there is a 20% swing, the lookback period changes from 12 months ago to the market high or low where the swing is measured from.

If you just look at the cumulative return you would say that Model B is much better. But is it really? There are some big differences in the performance of the two models in 2002 and 2003, but look at the difference in 2009. Essentially, all of the outperformance from Model B comes in 2009. In fact, if you ran these two models as of 12/31/2008 you would have said that Model A is better (+186% for Model A versus +154% for Model B).

You can’t simply look at the return streams of any model in a vacuum. There are reasons why the returns are what they are, and those reasons need to be considered. I think hitching your wagon to an RS strategy that makes a huge percentage of its relative (to other models) gains in a year like 2009 is asking for trouble. According to Leuthold’s research, the next set of laggard rallies that were difficult for RS were off the market lows in 1990, 2002, and 1938. All three of those instances were around 40% outperformance by the laggards over 12 months. This current laggard rally is almost 2 times that (77%).

Could it be that we have just seen the proverbial Black Swan of laggard rallies? It’s certainly possible. While a laggard rally of this magnitude can certainly happen again (and probably will at some point), the data suggests that relying on this type of rally to generate returns using an RS model over long periods of time is not wise. So like most things that get tested, I would say the idea of Model B was very interesting, but will wind up in the graveyard of good ideas.