How should today’s news, that the nation’s gross domestic product rose at a lower annual rate in the third quarter than previously estimated, factor into your investment decisions? Bad news for stocks?

Recently, Brandes issued a report, Gross Domestic Product: A Poor Predictor of Stock Market Returns, that points out that stock market performance has not been correlated with GDP performance. Note this research covers an 80 year period of time.

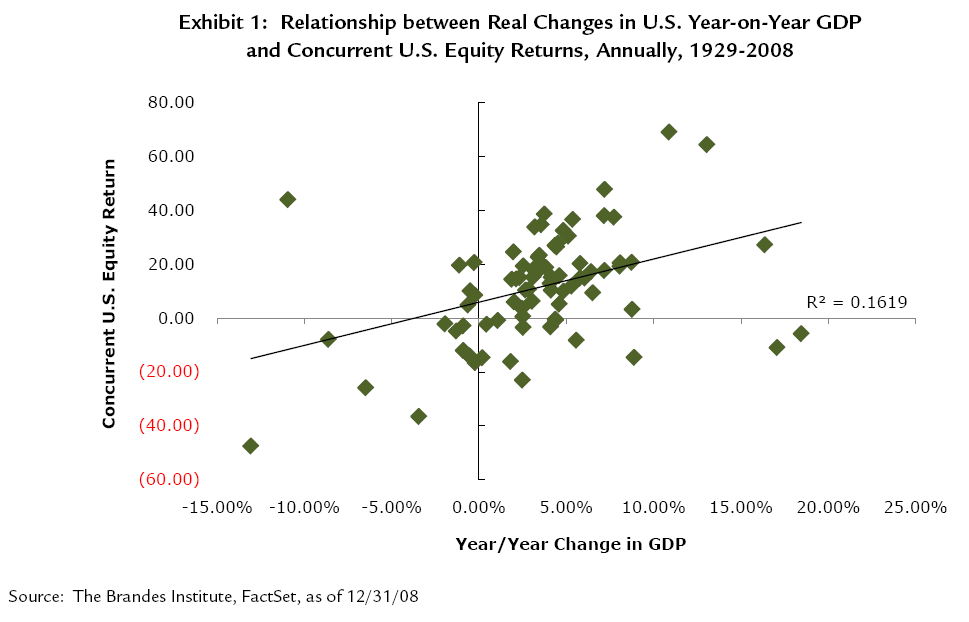

Exhibit 1 shows the predictive power of changes in GDP (in explaining concurrent equity returns) was not statistically significant. The coefficient of determination, or the portion of the stock market performance, explained by GDP changes, is only 0.1619, and the regression line is a poor fit.

(Click to Enlarge)

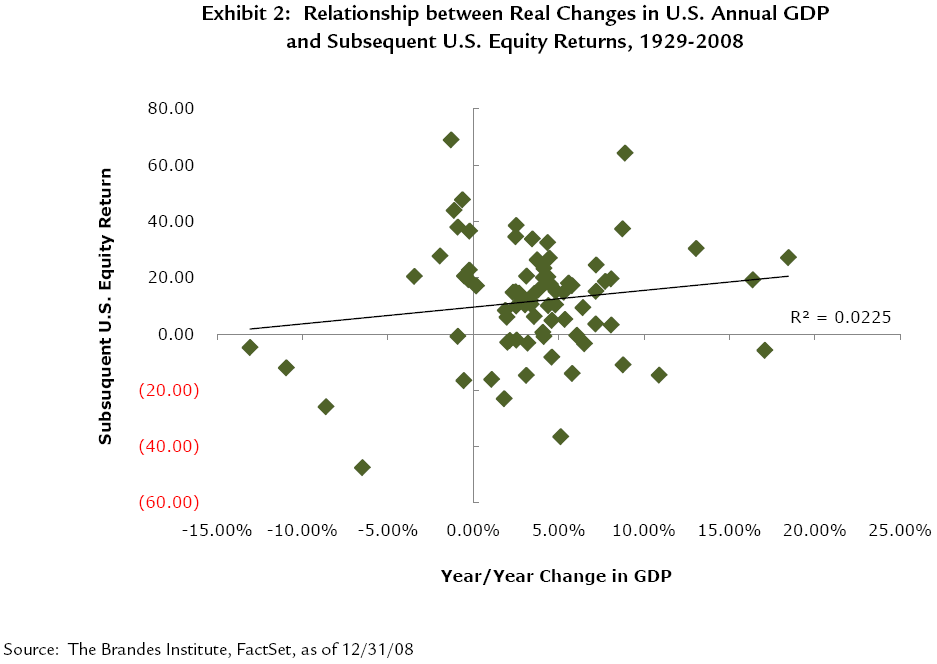

In addition, Exhibit 2 reveals that predictive power for changes in GDP in explaining subsequent equity returns is not statistically significant. The coefficient of determination for this relationship is 0.0225, and again, the fit of the regression line is poor.

(Click to Enlarge)

It may seem logical to you to try to link GDP growth with stock market performance, but the results just don’t back that thesis up. I believe that these results confirm that investors are best served by focusing on the price movement of a security/market itself when evaluating the merits of an investment.