The Journal of Indexes has the entire current issue devoted to articles on this topic, along with the best magazine cover ever. (Since it is, after all, the Journal of Indexes, you can probably guess how they came out on the active versus passive debate!)

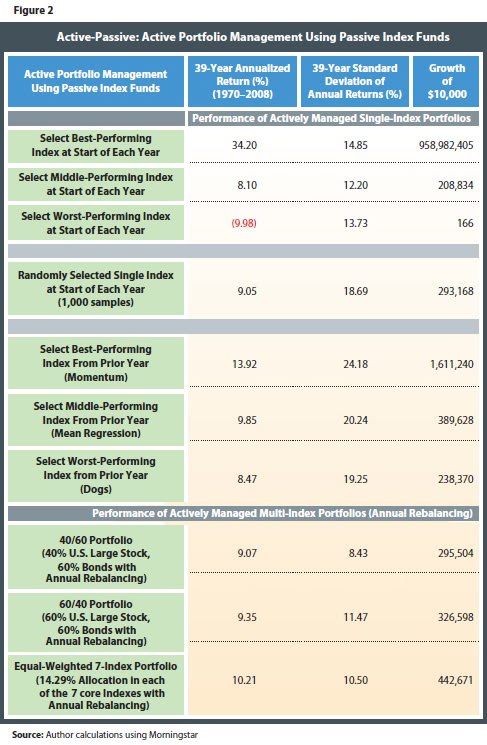

One article by Craig Israelson, a finance professor at Brigham Young University, stood out. He discussed what he called “actively passive” portfolios, where a number of passive indexes are managed in an active way. (Both of the mutual funds that we sub-advise and our Global Macro separate account are essentially done this way, as we are using ETFs as the investment vehicles.) With a mix of seven asset classes, he looks at a variety of scenarios for being actively passive: perfectly good timing, perfectly poor timing, average timing, random timing, momentum, mean reversion, buying laggards, and annual rebalancing with various portfolio blends. I’ve clipped one of the tables from the paper below so that you can see the various outcomes:

Click to enlarge

Although there is only a slight mention of it in the article, the momentum portfolio (you would know it as relative strength) swamps everything but perfect market timing, with a terminal value more than 3X the next best strategy. Obviously, when it is well-executed, a relative strength strategy can add a lot of return. (The rebalancing also seemed to help a little bit over time and reduced the volatility.) Maybe for Joe Retail Investor, who can’t control his emotions and/or his impulsive trading, asset allocation and rebalancing is the way to go, but if you have any kind of reasonable systematic process and you are after returns, the data show pretty clearly that relative strength should be the preferred strategy.

Posted by Mike Moody

Posted by Mike Moody