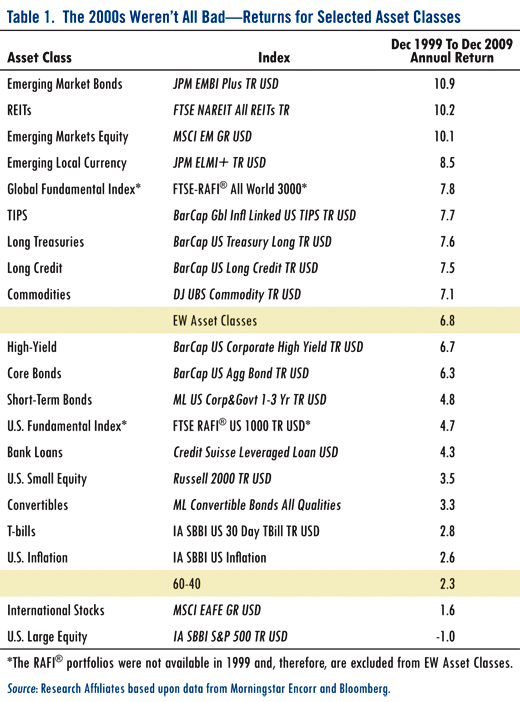

Rob Arnott is a thought leader in tactical asset allocation, currently well-known for his RAFI Fundamental Indexes. In his recent piece, Lessons from the Naughties, he discusses how investors will need to find return going forward.

The key to better returns will be to respond tactically to the shifting spectrum of opportunity, especially expanding and contracting one’s overall risk budget.

It’s a different way to view tactical asset allocation–looking at it from a risk budget point of view. The general concept is to own risk assets in good markets and safe assets in bad markets.

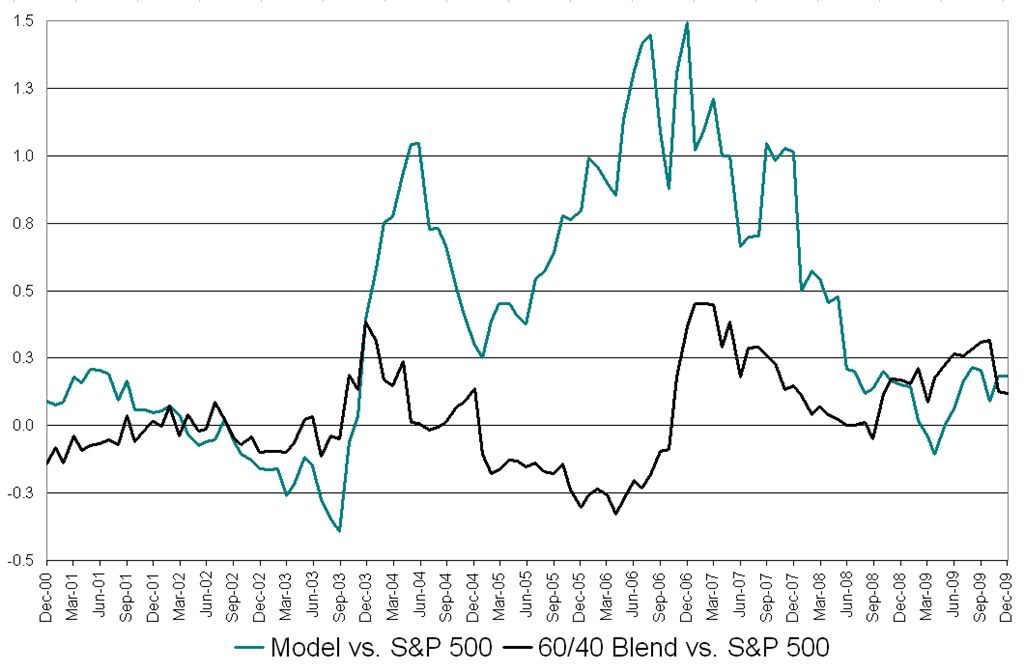

It turns out that systematic application of relative strength accomplishes this very well. The good folks at Arrow Funds recently asked us to take a look at how the beta in a tactically managed portfolio changed over time. When we examined that issue, it showed that as markets became risky, relative strength reduced the beta of the portfolio by moving toward low volatility (strong) assets. When markets were strong, allocating with relative strength pushed up the beta in the portfolio, thus taking good advantage of the market strength.

click to enlarge

Using relative strength to do tactical asset allocation, the investor was not only able to earn an acceptable rate of return over time, but was able to have some risk mitigation going on the side. That’s a pretty tasty combination in today’s markets.