Index Universe has a provocative article by Rob Arnott and John West of Research Affiliates. Their contention is that 2000-2009 was not really a lost decade. Perhaps if your only asset was U.S. equities it would seem that way, but they point out that other, more exotic assets actually had respectable returns.

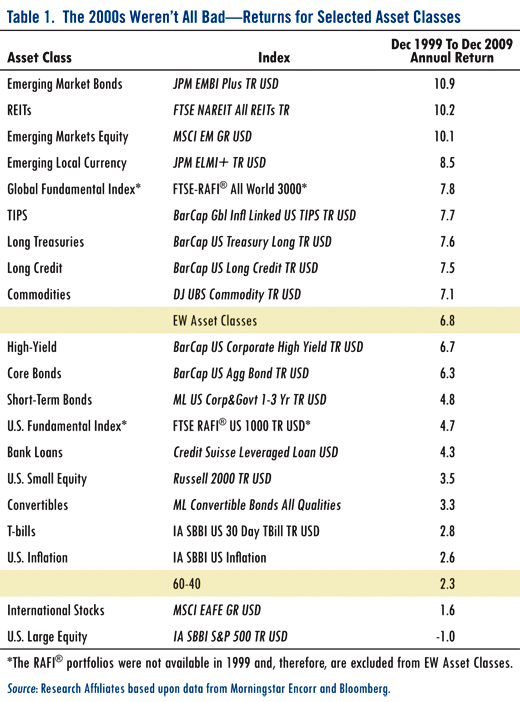

The table below shows total returns for some of the asset classes they examined.

click to enlarge

What are the commonalities of the best performing assets? 1) Lots of them are highly volatile like emerging markets equities and debt, 2) lots of them are international and thus were a play on the weaker dollar, 3) lots of them were alternative assets like commodities, TIPs, and REITs.

In other words, they were all asset classes that would tend to be marginalized in a traditional strategic asset allocation, where the typical pie would primarily consist of domestic stocks and bonds, with only small allocations to very volatile, international, or alternative assets.

In an interesting way, I think this makes a nice case for tactical asset allocation. While it is true that most investors-just from a risk and volatility perspective-would be unwilling to have a large allocation to emerging markets for an entire decade, they might find that periodic significant exposure to emerging markets during strong trends would be quite acceptable. And even assets near the bottom of the return table like U.S. Treasury bills would have been very welcome in a portfolio during parts of 2008, for example. You can cover the waterfront and just own an equal-weighted piece of everything, but I don’t know if that is the most effective way to do things.

What’s really needed is a systematic method for determining which asset classes to own, and when. Our Systematic Relative Strength process does this pretty effectively, even for asset classes that might be difficult or impossible to grade from a valuation perspective. (How do you determine whether the Euro is cheaper than energy stocks, or whether emerging market debt is cheaper than silver or agricultural commodities?) Once a systematic process is in place, the investor can be slightly more comfortable with perhaps a higher exposure to high volatility or alternative assets, knowing that in a tactical approach the exposures would be adjusted if trends change.

Posted by Mike Moody

Posted by Mike Moody