Since 1994, Morningstar has been tracking a strategy of buying the asset classes that had the largest net outflows and then holding the positions for three years before rotating them out. The essential idea is just to buy an asset class when it is out of favor and hold on to it patiently, long enough to reap the gains. In effect, this is simply doing the opposite of what most investors do. The strategy produces better than market returns over both three-year and five-year time horizons.

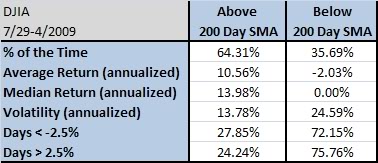

From 1994 through 2009, the buy-the-unloved strategy produced an annualized 8.1% return, compared with 4.77% for the loved, 6.24% for the S&P 500, 6.96% for the Wilshire 5000, and 5.36% for the MSCI World. This assumes you invest in the unloved categories for three years running and then roll over the oldest group into the new unloved group starting in year four.

The strategy also produced strong results if you run it on a five-year rotation. In that version, the unloved produced an 8.08% annualized return, compared with 4.25% for the loved, 5.17% for the S&P 500, 5.76% for the Wilshire 5000, and 4.55% for the MSCI World.

While it is no shock that going opposite retail (and institutional pension funds!) investors is profitable, it may be a bigger surprise what the portfolio is buying this year.

Based on the 12-month flows through the end of January, the unloved categories to buy now are large-cap growth, large-cap value, and world stock.

Note: this would be a good time to point out that our Systematic RS Aggressive and Core portfolios fit solidly within the large-cap category! I will be pleasantly surprised if we begin to see flows into our domestic equity products by far-seeing, patient advisors. Industry practice is to wait until there is a good marketing window for retail investors-usually after a year or two of strong performance. There’s nothing wrong with that, but since the timing isn’t optimal, investors have to be prepared to weather a couple of cycles to really get maximum benefit from the strategy. If I were in advertising, I would advise you to beat the rush and buy domestic large cap stocks today!

Posted by Mike Moody

Posted by Mike Moody