Relative strength is no longer the Rodney Dangerfield of investing.

In a watershed event for relative strength investing, Morningstar will begin to consider “momentum” as a return factor. This nugget was disclosed in a Portfolio Strategy article that appeared in today’s Wall Street Journal.

For many years, academic researchers believed a stock’s performance could be explained by three primary factors: the market where the stock traded, the size of the company, and the stock’s style, along a continuum from shares of fast-expanding “growth” companies to seemingly cheap value stocks.

But now, the academic community has “coalesced” around recognition of momentum as the “fourth factor,” says Mr. Rekenthaler, a sentiment echoed in recent research.

Momentum, as you may recall, is the name academics use for relative strength. Academic research began appearing on momentum in the 1990s, although market technicians have been writing about-and using-relative strength at least since the 1930s. (My theory is that academics and value investors can’t stand to admit that technical analysis has tremendous value.)

Morningstar didn’t stop with just the recognition of relative strength as a return factor. They’re going to measure it:

In a sign of just how popular this idea is becoming, Morningstar Inc. this summer will roll out a new gauge: The research firm will assign U.S. and international stocks a score between 1 and 100 for momentum and take the mean momentum score of a mutual fund’s holdings to give the fund an overall momentum ranking. If funds that consistently score highly on momentum perform similarly, Morningstar might eventually create a new category of momentum-oriented funds, says John Rekenthaler, vice president of research at the firm.

The other salient point that the Wall Street Journal article makes is something that we have emphasized often on this blog. Relative strength strategies and deep value strategies are often complementary. The article references the work of Clifford Asness at AQR:

Mr. Asness co-authored a 2009 study entitled “Value and Momentum Everywhere,” which suggested that investors can hedge themselves and boost returns with a simple combination of momentum and value strategies—in stocks and all other asset classes.

In the past, many investors looked to hold a mix of value-oriented and growth-oriented stocks or funds, since the two were thought to take turns in favor. Now AQR suggests that momentum, rather than growth, is the right foil for value strategies.

There’s one area where I take issue with the article. It suggests that relative strength has no fundamental underpinning; that it is purely a psychological phenomenon, or somehow related to group-think:

These momentum trends in markets have more to do with the faddishness of human behavior than the fundamentals of economics and balance sheets. In essence, investors often flock to the stocks that have been going up, which tends to propel them further.

That is a very incomplete description of how relative strength works. A number of academic studies have shown that part of the push behind relative strength is that new information sifts into the market gradually and that the time-release effect is one of the drivers of relative performance. Fundamental analysts often comment that a positive earnings revision is frequently followed by another-the so-called “cockroach effect.” Analysts tend to adjust their earnings estimates more slowly than they should and relative strength is often just recognition of improved prospects in the market running ahead of the analysts’ conservative thinking.

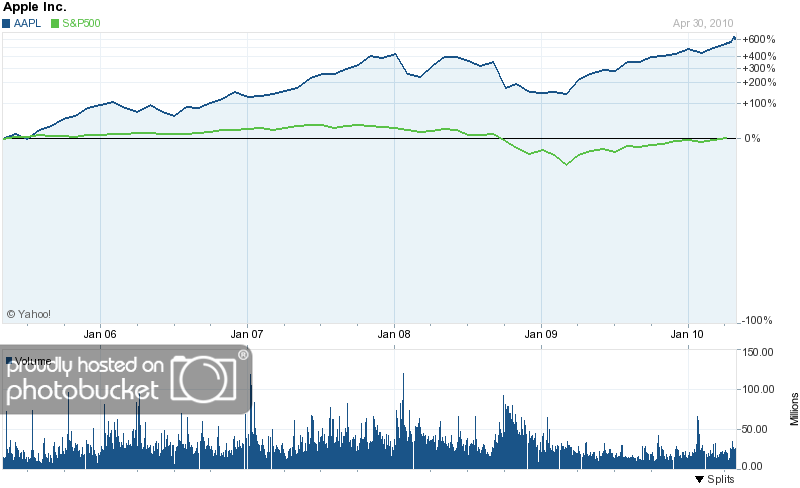

Indeed, relative strength is typically driven by fundamentals. For example, the largest weight in the PowerShares DWA Technical Leaders Index (PDP) is Apple Computer (AAPL). If you look at a chart, you can see that it has vastly outperformed the S&P 500 index over the past few years.

click to enlarge

Is that because investors are blindly flocking to it because it has been going up, or is it in recognition of the earnings per share going from $2.27 (9/2006) to $6.29 (9/2009), with a consensus estimate of $13.08 for this fiscal year? In our view, it’s simple math. Earnings going from $2 to $13 merits an increase in the stock price. Value investors can debate if Apple is cheap or expensive, but the market has already voted. In other words, if a stock is outperforming the market and its peer group, it’s typically because the fundamentals are superior.

That caveat aside, I would like to tip my cap to Morningstar and the Wall Street Journal. It’s about time that relative strength gets the respect it deserves.

[...] Recognition is a Long Time Coming « Systematic Relative Strength [...]

[...] a gauge of institutional acceptance, Morningstar recently announced plans to include momentum as a return factor and will begin to rate funds by the average level of momentum in the holdings as well. (It [...]