Strategic asset allocation has a powerful hold on people. Investors seem completely willing to forgive and forget all of the problems with it-apparently no matter how much pain or harm it caused. That’s my conclusion after reading an article on asset allocation from CNBC.com. The article mentions that investors started to question asset allocation because of results:

…the process of diversifying one’s portfolio across a variety of asset classes was put to the test during the 2008-2009 market meltdown. And the outcome wasn’t good.

Investors who had dutifully spread their eggs among multiple baskets and stayed the course, a.k.a. buy and hold, watched helplessly from the sidelines as their retirement accounts lost a collective $2.8 trillion between the market peak in October 2007 and the trough in March 2009, the Center for Retirement Research at Boston College reports.

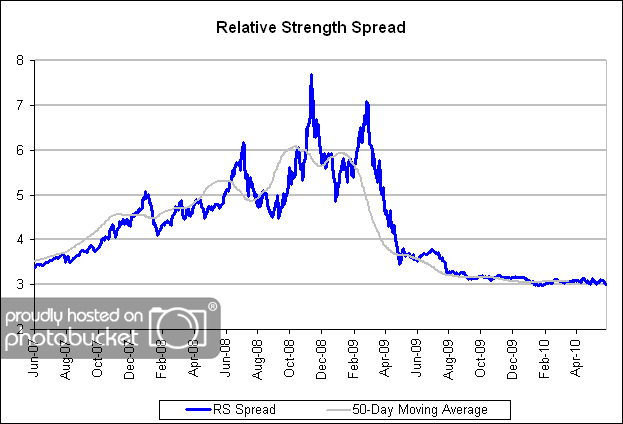

We’ve written many times about one of the problems with a cornerstone of strategic asset allocation: correlations between asset classes are not stable over time. And, in fact, this is cited in the article as one of the causes of the poor outcome.

Asset allocation, of course, is predicated on the premise that investors can limit downside risk by owning a mixed bag of non-correlated securities, like stocks and bonds, which historically move in opposite directions during any given market cycle.

“You saw large-cap and small-cap stocks, international and domestic all going down together—the good stocks with the bad,” says [Elliot] Herman [an investment advisor for NFP Securities in Quincy, Mass].

The problem of unstable correlations is one of the reasons we think tactical asset allocation can be useful. If relative strength is used to drive the allocation engine, no assumptions are made about asset class relationships. The portfolio is simply allocated to whatever assets have had the best intermediate-term relative strength, whether they are supposedly correlated or not. That’s why I was stunned to read this later in the article:

Yet, hindsight brings wisdom. Now a year into a convincing market recovery, many in the financial community say standard asset allocation is still the key to the kingdom for average investors.

Excuse me? The key to the kingdom, really? That doesn’t sound like wisdom to me, even in hindsight, unless practitioners of strategic asset allocation are hoping the average investor has been clubbed into an amnesiac state. What I think it really means is this: Never mind your $2.8 trillion. As long as we still have your money, we’re going to pretend everything is a-ok with this failed paradigm.

Illustration: Pie Chart Malfunction

I’m not saying strategic asset allocation is useless: diversification and looking for uncorrelated assets are valuable principles. Incorporating some alternative asset classes might help as well. And strategic asset allocation is certainly an improvement over emotional asset allocation, which seems to be most investors’ default option. However, being beaten to death by a pie chart every couple of market cycles is not my idea of fun either. There are inherent difficulties in mean variance optimization-forecasting returns, estimating volatility, and unstable correlations between asset classes.

Tactical asset allocation done in some kind of systematic way, whether through relative strength or deep value, is certainly worth examining with an open mind as an alternative to strategic asset allocation.

Posted by Mike Moody

Posted by Mike Moody