The only thing we learn from history is that we learn nothing from history. — Friedrich Hegel

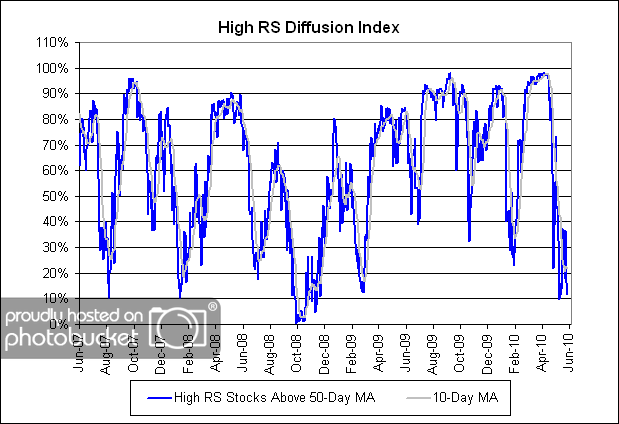

There are few things I enjoy more than digging into a juicy morsel of stock market history. Roger Schreiner’s excellent article from Investment Advisor magazine certainly fits the bill, with a twist. The twist is that Mr. Schreiner examines the recent history of the Japanese stock market, which holds valuable lessons when trying to decide between an active, tactical approach and a passive approach. Here, for example, is one of the charts from the article demonstrating how difficult the market has been.

Source: Investment Advisor and dshort.com

He concludes, after his discussion of the Japanese experience:

You don’t have to be a market historian to know that stock markets are risky. But proponents of buy and hold would rather that you not focus on the stock market in Japan, or anywhere else for that matter. After all, the history of the U.S. stock market reads more like a romance novel, if you ignore a few of the most recent chapters, and that’s the story they would much rather tell.

History supports the idea that buy-and-hold investing is unlikely to provide acceptable returns. Wishful thinking and cherry-picking slices of market history that support passive investing are the only ways Wall Street can justify exposing investors’ assets to a passive philosophy.

He’s right that the deflation of the asset bubble in Japan is not often discussed in the United States. When it is, it is usually dismissed as a poor analog for cultural reasons. But what if it’s not a poor analog? In fact, cross-cultural studies of investor behavior suggest that markets and investors act pretty much the same everywhere. Maybe it’s time to learn something from history for a change.

Posted by Mike Moody

Posted by Mike Moody