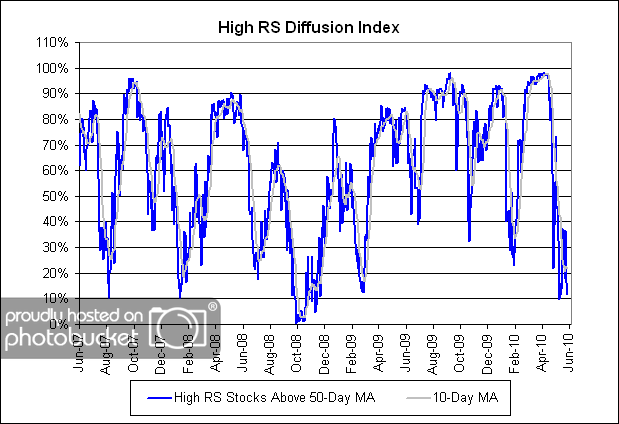

The chart below measures the percentage of high relative strength stocks that are trading above their 50-day moving average (universe of mid and large cap stocks.) As of 6/8/10.

(Click to Enlarge)

The 10-day moving average of this indicator is 22% and the one-day reading is 12%. The correction in the market over the last month has brought this indicator into oversold territory. Dips in this indicator have often provided good opportunities to add to relative strength strategies.

[...] are good and you get plenty of opportunities to add money during the dips. Toward that end, we publish a High RS Diffusion Index each week to help identify those dips in our [...]