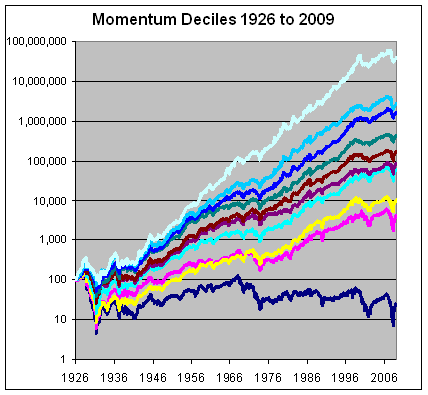

Using data from Dr. Ken French’s website, Eddy Elfenbein has posted updated performance of momentum models that cover the 1926-2009 period. Elfenbein states, “This is one of the most fascinating phenomena in finance. Stocks that have done well, on average, continue to do well.”

The chart shows the historical performance of stocks ranked by momentum decile (meaning 10% slices).

The deciles are perfectly rank ordered. The stocks that had been doing the best, do the best. The stocks that had been doing the worst, fare the worst.

The data comes from Dr. Ken French’s website. Just to be clear, momentum is defined by performance over the 11-month period starting 12 months ago and ending one month ago. The one-month directly prior to each period is excluded. At the end of the month, the whole thing is repeated. The data series goes back over 80 years.

Here’s how each decile has performed:

Decile 1: 16.79%

Decile 2: 13.11%

Decile 3: 12.42%

Decile 4: 10.63%

Decile 5: 9.42%

Decile 6: 8.47%

Decile 7: 8.05%

Decile 8: 5.73%

Decile 9: 4.54%

Decile 10: -1.73%

Such superior results achieved by momentum, aka relative strength, is exactly why we have based our entire management process on its application.

Past performance is no guarantee of future results.

Posted by Andy Hyer

Posted by Andy Hyer