Dorsey Wright Analyst, Susan Morrison, and Dorsey Wright Portfolio Manager, John Lewis, recently completed a podcast (click here to listen) in which they discuss the performance and current allocations of the PowerShares Technical Leaders Indexes (PDP, PIE, and PIZ). Noteworthy overweights and underweights for each of the ETFs are discussed. PDP is the U.S. Technical Leaders ETF; PIE is the Emerging Markets Technical Leaders ETF; and PIZ is the Developed International Markets Technical Leaders ETF.

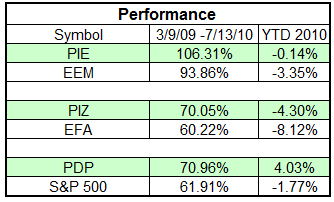

As shown in the table below, each of these ETFs has outperformed its respective benchmark since the beginning of the current bull market and also YTD (1/1/10 - 7/13/10).

Additional information and disclosures for each of the ETFs can be found at www.powershares.com.

Posted by Andy Hyer

Posted by Andy Hyer