Our latest sentiment survey was open from 8/13/10 to 8/20/10. We saw a nice uptick in the response rate, with 143 readers participating. Your input is for a good cause! If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are comfortable about the statistical validity of our sample. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. Client fear continues to dominate our broad sentiment index. 93% of clients were fearful of a downdraft, nudging higher from last survey’s 92%. Since the last survey, the market has fallen around 2%; the market chop over the last 2 months or so has not alleviated any of the client fear we’ve been documenting. In fact, in our last survey report, we noted that a +7% rally in the market had little, if any, effect on client sentiment. It looks like it’s going to take *at least* a +10% sustained move to get the fear numbers below 90%. And with this market incapable of holding any kind of momentum in either direction, it’s anyone’s guess as to when clients will start to feel pressure to get back into the market.

Chart 2. Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread remains significantly skewed towards fear of losing money this round. This survey’s reading was 86%, just higher than last week’s reading of 84%. The spread has remained in a tight 5% spread since the beginning of July, as the market continues to trade within a similar range on its own chart.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. Average risk appetite has been trading within a fairly steady range since the end of May, pointing to a long-term patten of low-risk tolerance during times of heightened market uncertainty. Right now the average risk appetite for all participants is 2.10, just down from last week’s reading of 2.24. There’s not much to add at this point; the average risk appetite number syncs up perfectly with our observations so far. Right now we are in a fearful environment, where hardly anyone wants to take any risk. See here for some commentary on the wisom of going to bonds to avoid equity risk.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. Right now the bell curve is biased to the low-risk side, as it has been for the few months. What we see in the bell curve is more evidence that clients are afraid of losing money in the market. This week we had a grand total of two respondents with a risk appetite of 5 (Take Risk). There is basically zero appetite for risk right now among our clients.

Chart 5: Risk Appetite Bell Curve by Group. The next three charts use cross-sectional data. This chart plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. We would expect that the fear of downdraft group would have a lower risk appetite than the fear of missing upturn group and that is what we see here.

Chart 6: Average Risk Appetite by Group. A plot of the average risk appetite score by group is shown in this chart. These readings come exactly into line with what we’ve noticed before. The downturn group’s average risk appetite clocked in at 2.05, while the upturn group’s came in at 2.90. In past survey reports, we’ve noted that the upturn group has a much more volatile average risk appetite, which moves in large swings when compared to the downturn group. Whether this is based on a small sample size (this round we had 10 upturn participants) or some other underlying factor, we’ve yet to decide. At this point, it’s just helpful to see the groups acting as they should with regards to their respective risk appetites.

Chart 7: Risk Appetite Spread. This is a spread chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread is currently .85, down moderately from last week’s spread of 1.06.

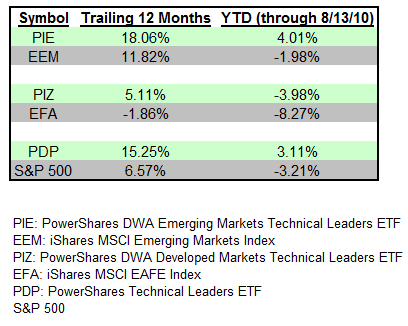

As a whole, our participants have been responding to market action exactly as we would expect them to, in all aspects of the survey. During a market rally, we see a shift from a fear of decline to a fear of missed oppurtunity, and the opposite has held true when the market declines. Investors want to participate in rallies, but it takes a big rally to get everybody on board. Conversely, investors want to avoid losses, but it takes a big drop in the market to get everybody out of the market. In some ways, it seems like 2008 is all too fresh in Joe Investor’s mind. The Trailing Twelve Month return for the S&P 500 is +7.9%, and year to date the S&P is down around -3.5%. When you compare those fairly innocuous returns against the massive wall of fear evident in our sentiment surveys, it becomes clear that the bloodbath of 2008 is still weighing on the market. In the last survey, I asked how much of a rally is needed to get Joe Investor back in the market. It’s clear that +10% won’t cut it…how about +25%? +50%?

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating!