Tobias J. Moskowitz, PhD has a nice article on momentum investing in the July/August issue of IMCA’s journal, Investments & Wealth Monitor (linked here with permission from IMCA). As pointed out in the article, Dorsey Wright is among those providing momentum (aka relative strength) products to investors:

Known to financial academics for many years, momentum investing is a powerful tool for building portfolio efficiency, diversification, and above-average returns. Until recently, momentum investing has been difficult to access for most investors, but that is changing.

A couple firms recently launched products that give more investors access to momentum. Some are technical, such as Dorsey-Wright’s ETF: others, such as MSCI, are based on proprietary models.

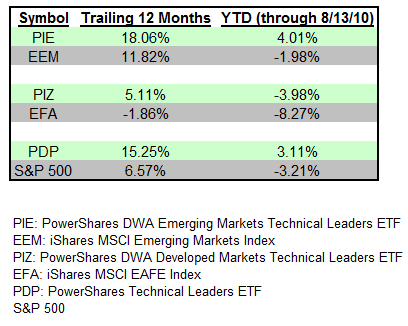

My emphasis added. In fact, Dorsey Wright provides three technical leaders indexes that are used to manage PDP, PIE, and PIZ. Trailing twelve-month performance and year-to-date performance is shown for each relative to their benchmark. As shown in the table, each have performed better than their benchmark over the past 12 months and YTD.

After detailing much of the academic testing of momentum investing on U.S. equities, Moskowitz then turns to the rest of the world and other asset classes. His conclusion: it was found to work pretty much everywhere!

The original momentum studies focused on U.S. equities during the period 1963-1990. Subsequent studies found momentum as far back as the Victorian age (Chabot et al. 2009) and in the out-of-sample period after the original research was published (Carhart 1997, Jegadeesh and Titman 2001, Grundy and Martin 2001, Asness et al. 2009). Momentum has been found in markets in Europe (Rouwenhorst 1998), in emerging markets (Rouwenhorst 1999), in Asia (Chui e al. 2000), and in 40 different markets globally (Griffin et al. 2005). Momentum also has been documented among other asset classes than individual stocks, e.g., bonds, commodities, and currencies (Asness et al. 2009); industries (Moskowitz and Grinblatt 1999, 2004; Asness et al. 2000), and country indexes (Asness et al. 1997).

Among the possible explanations for momentum, Moskowitz says:

Several possible behavioral explanations have been put forth, many based on the Nobel memorial prize-winning work of Daniel Kahneman and Amos Tversky. One explanation posits that investors may be slow to react to new information: different investors (e.g., a trader vs. a casual investor) receive news from different sources and react to news over different time horizons and in different ways. This “anchoring and adjustment” is a behavioral phenomenon in which individuals update their views only partially when faced with new information, slowly accepting its full impact. Ample evidence supoports slow-reaction-to-information theories ranging from market response to earnings and dividend announcements to analysts’ reluctance to update their forecasts.

Overall, Moskowitz’s article is a great overview of momentum investing and makes a compelling case for employing momentum strategies as part of an asset allocation. However, we couldn’t help smile when noting the irony that the author, Tobias J. Moskowitz, PhD, is currently the Fama Family Professor of Finance at The University of Chicago Booth School of Business, given that Eugene Fama (along with Ken French) have arguably done more to advance the theory of the Efficient Markets Hypothesis than any other academics. Regular readers of our blog may remember one of our earlier rants on the topic. But, I digress. A vast amount of research supports Moskowtiz’s conclusion that “Momentum is a powerful investment style, nearly unmatched in its predictive strength and robustness.”

Disclosures for PDP, PIE, and PIZ can be found at www.powershares.com.