A few months ago I had a post about the Momentum Echo (click here to read the post). I ran across another relative strength (or momentum if you prefer) paper that tests yet another factor. In Seung-Chan Park’s paper, “The Moving Average Ratio and Momentum,” he looks at the ratio between a short-term and long-term moving average of price in order to rank securities by strength. This is different from most of the other academic literature. Most of the other studies use simple point-to-point price returns to rank the securities.

Technicians have used moving averages for years to smooth out price movement. Most of the time we see people using the crossing of a moving average as a signal for trading. Park uses a different method for his signals. Instead of looking at simple crosses, he compares the ratio of one moving average to another. A stock with the 50-day moving average significantly above (below) the 200-day moving average will have a high (low) ranking. Securities with the 50-day moving average very close to the 200-day moving average will wind up in the middle of the pack.

In the paper Park is partial to the 200-day moving average as the longer-term moving average, and he tests a variety of short-term averages ranging from 1 to 50 days. It should come as no surprise that they all work! In fact, they tend to work better than simple price-return based factors. That didn’t come as a huge surprise to us, but only because we have been tracking a similar factor for several years that uses two moving averages. What has always surprised me is how well that factor does when compared to other calculation methods over time.

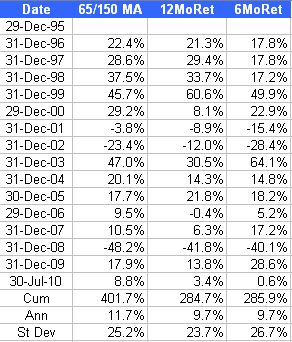

The factor we have been tracking is the moving average ratio of a 65-day moving average to the 150-day moving average. Not exactly the same as what Park tested, but similar enough. I pulled the data we have on this factor to see how it compares to the standard 6- and 12-month price return factors. For this test, the top decile of the ranks is used. Portfolios are formed monthly and rebalanced/reconstituted each month. Everything is run on our database, which is a universe very similar to the S&P; 500 + S&P; 400.

(click to enlarge)

Our data shows the same thing as Park’s tests. Using a ratio of moving averages is significantly better than just using simple price-return factors. Our tests show the moving average ratio adding about 200 bps per year, which is no small feat! It is also interesting to note we came to the exact same conclusion using different parameters for the moving average, and an entirely different data set. It just goes to show how robust the concept of relative strength is.

For those readers who have read our white papers (available here and here) you may be wondering how this factor performs using our Monte Carlo testing process. I’m not going to publish those results in this post, but I can tell you this moving average factor is consistently near the top of the factors we track and has very reasonable turnover for the returns it generates.

Using a moving average ratio is a very good way to rank securities for a relative strength strategy. Historical data shows it works better than simple price return factors over time. It is also a very robust factor because multiple formulations work, and it works on multiple datasets.

Another moving-average-based alternative to using point-to-point momentum is taking the moving average of momentum …

For example, if you check simple momentum ranks daily, it’s very noisy; the primary solution has been, “don’t check daily,” i.e. check monthly or quarterly and rerank and rebalance holdings.

However, you can check daily, and potentially rebalance daily, with much less noise if, instead of using 12 month momentum, you use the 21-day moving average of 252-day momentum. This is also equivalent, BTW, to the ratio of today’s 21-day moving average to the 21-day moving average.

The advantage of using the momentum average is that you have more responsiveness to changes in momentum than you do if you check the universe once/month or once/quarter. Certainly it is much more manageable to use the MA technique if you have a smaller universe to apply it to; since I use a group of ETFs as my universe, it works well for me. Given that you’re working in a universe of 900+ stocks and disclosing holdings in a fund format, it may not be applicable to you, but I thought you might find it interesting.

This is also equivalent, BTW, to the ratio of today’s 21-day moving average to the 21-day moving average [FROM 252 DAYS AGO - EDIT].

We also track factors that take a moving average of a momentum calculation or score. The old technicians’ trick of using a MA to smooth out the noise works on relative strength just like it does on raw price.

The frequency of rebalance often determines what kind of model you can use. We run strategies that can only be rebalanced once a quarter, and we have to use different models for those than we do for strategies we look at daily or weekly. Both methods work if you use the proper factor, and we haven’t found that increasing the rebalance frequency automatically increases return. Sometimes it takes away from the return. It totally depends on the factor and how you implement it (at least in my experience).

With the universes and parameters I’ve tested it on, I have not noted what I would call “statistically significant” improvements in return when switching from monthly rebals to moving average techniques that allow for (potentially, at least) daily rebals. What I’ve noted has been for the most part what I’d call equivalent returns in the backtest data. I have particularly noted that the average number of trading roundtrips/year is only very slightly higher with the daily change potential, i.e., there are some whipsaws, but only a few.

What I personally like about the potential for daily changes is, if hypothetically one of the issues I’m in crashes and burns, the MA technique would exit more quickly (and replace with another security). Obviously that didn’t happen enough over the course of the backtests to drive a significant difference in result, but it does provide a nice salve to my psyche.

I suppose when I’m retired and running my program from some beach somewhere, I’ll prefer only having to check in monthly, though. That’s later. For now while I’m on the computer daily anyway, might as well run my scans!

For now while I’m on the computer daily anyway, might as well run my scans!

“I’m not going to publish those results in this post, but I can tell you this moving average factor is consistently near the top of the factors we track and has very reasonable turnover for the returns it generates”

Great post - would love to see more on this John

Interesting post indeed - i have been reading a lot of papers on this and researching its effectiveness…

The one thing I cannot comprehend is how come a fund such as AQR which proposes another form of momentum investing does so badly.

Their theorectical returns are around 13% a year but the actual fund is still in minus.

Wonder whether live investing with this idea of yours will yield results close to the tested amounts…

Ceaipentru marire…

[…]Moving Average Ratio and Momentum « Systematic Relative Strength[…]…

We stumbled over here by a different web page and

thought I might check things out. I like what I see so now i am following you.

Look forward to looking into your web page for a second time.

Also, they need to fulfioll 150 semester hours with 33 hours of accounting classes aand 36 hours of business classes.

After reaching my accountant and relaying my concerns, the

next attribute worth addressing is communication. An accountant can present you with an accurate picture of your cash flow

and plzces which need attention, to ebsure that you know where you

can focus your efforts.