Our latest sentiment survey was open from 9/24/10 to 10/1/10. We saw a decrease in the response rate, with 91 readers participating. Your input is for a good cause! If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are comfortable about the statistical validity of our sample. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

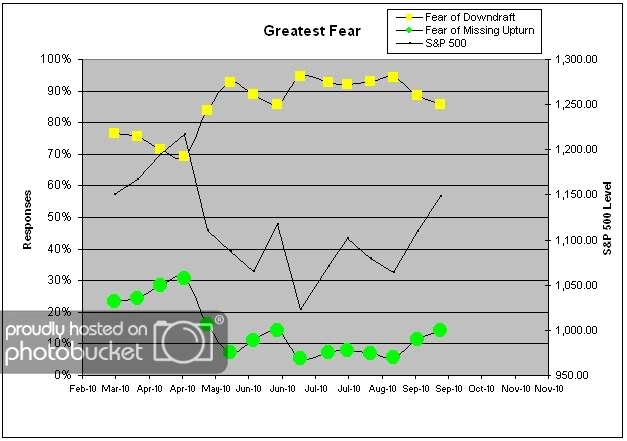

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. Now we got a rally going! And guess what…client fear levels are moving in-line, as predicted. Using only the survey data points, the market has rallied around 8% since August. 86% of clients were afraid of losing money this round, versus 14% of clients who were afraid of losing out on a rally. Contrast this with the most recent August lows, where 94% of clients were fearful of losing money. Let’s do some simple math: An 8% market rally corresponds to an 8% client fear level move! The two are moving lock-step with each other. The only question is whether it’s going to take a 40% market move to get client fear levels to a 50/50 split. Only time will tell.

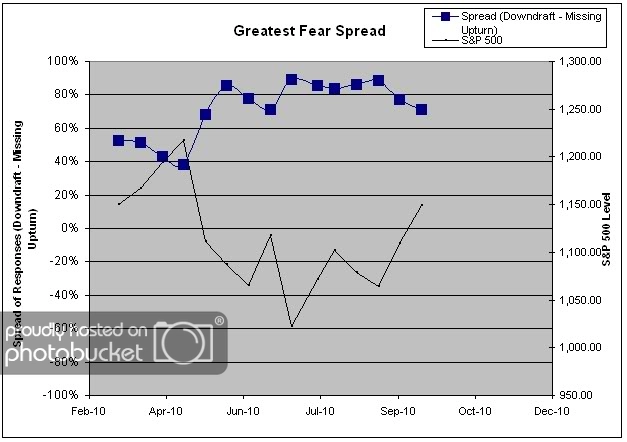

Chart 2. Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread remains skewed towards fear of losing money this round. Same as with the general fear numbers, the market move has corresponded exactly with a move in the spread between the two groups. Right now the spread is at 71%.

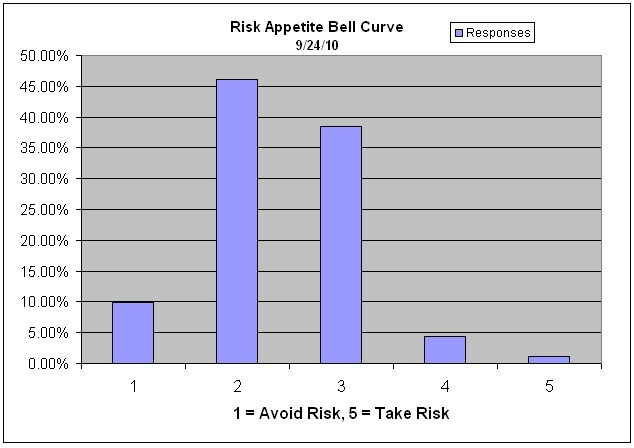

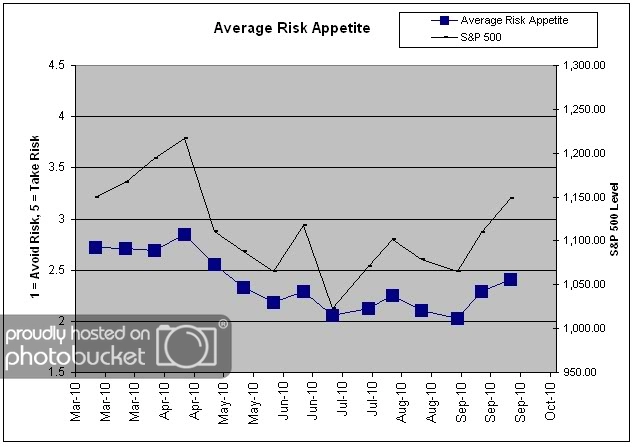

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. The market move has led to the average risk appetite scoring the highest number since May! That’s a big breakout after holding a pretty tight range for the entire summer. Right now average risk appetite is 2.4, up from last week’s 2.3, and well off the most recent lows of 2.0. It’s great to see all of our indicators working exactly as we thought they would.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. Even with the modest rally and the shift towards more risk, clients are definitely not taking many chances in this market. With this indicator, we would expect the bell curve to shift towards more risk if the market continues to rally into the fall.

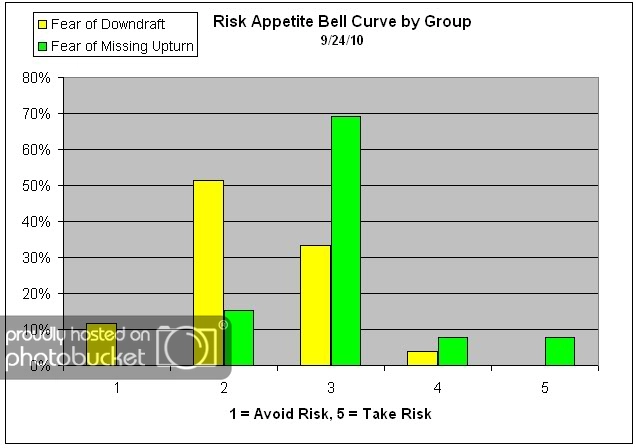

Chart 5: Risk Appetite Bell Curve by Group. The next three charts use cross-sectional data. This chart plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. We would expect that the fear of downdraft group would have a lower risk appetite than the fear of missing upturn group and that is what we see here.

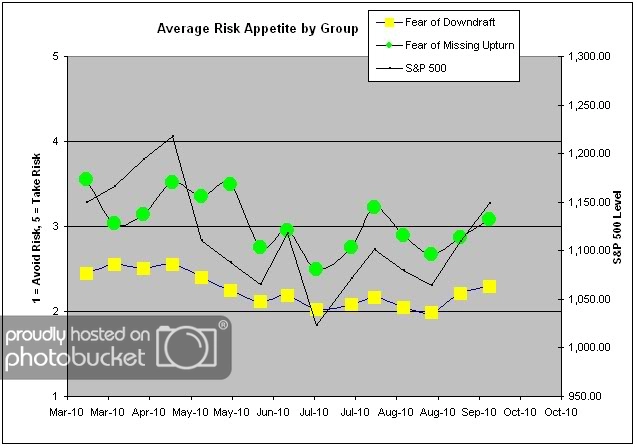

Chart 6: Average Risk Appetite by Group. A plot of the average risk appetite score by group is shown in this chart. Here we see that the average risk appetite for the fear of losing money group is significantly lower than the risk appetite for the fear of missing the rally group — perfect. Both averages have spiked in-line with the market, which is also reflected in the general average risk appetite chart. This time, we saw the upturn group have a little bit more volatility, but not as significantly as we’ve seen before. Currently the average risk appetite of the downturn group is 2.3 and the risk appetite of the upturn group is 3.1.

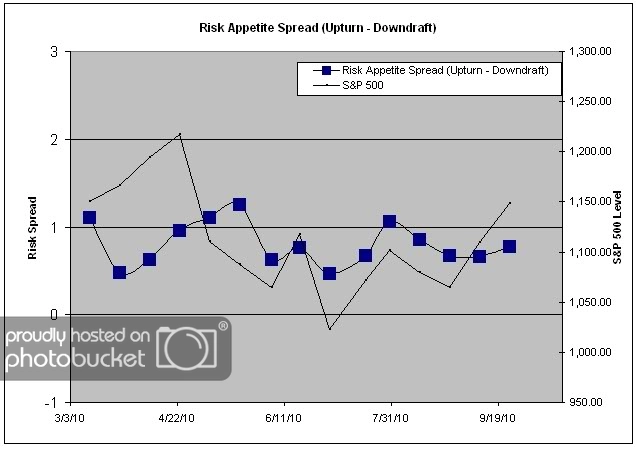

Chart 7: Risk Appetite Spread. This is a spread chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread has become a little bit more stable during the rally, as both groups react to market performance at around the same pace. Right now the spread is .78, up about 10 basis points from last week’s .66. It’s not that large of a move considering that we’ve seen moves of close to 50 basis points in just two weeks before.

The current survey numbers show just how consistently client sentiment is linked to short-term market performance. We see an 8% market move, we get an 8% fear level move. Is it really that simple? One would hope not, but unfortunately, all signs point to “Yes” at the moment. Short term market performance should not be closely tied to long-term market outlook!! But it is. Advisors, it’s clearly a tough job to keep your clients’ emotions in check.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating!

Posted by JP Lee

Posted by JP Lee