Our latest sentiment survey was open from 12/17/10 to 12/24/10. The survey continues to experience a “holiday malaise,” with only 72 particpants responding. Things will surely pick up once the new year gets rolling. Your input is for a good cause! If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are comfortable about the statistical validity of our sample. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

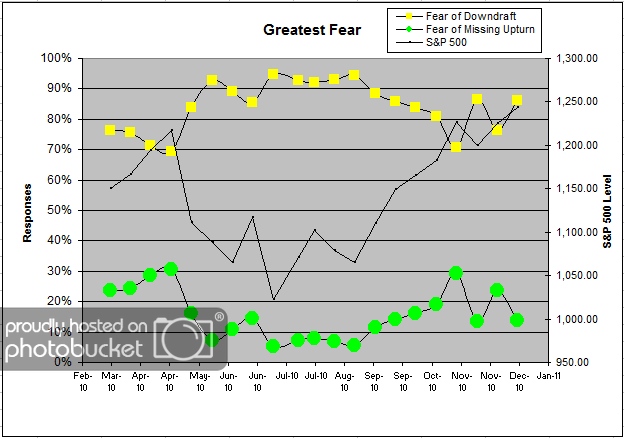

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

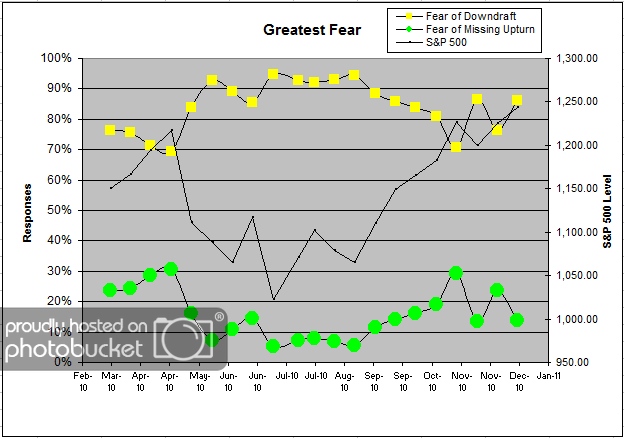

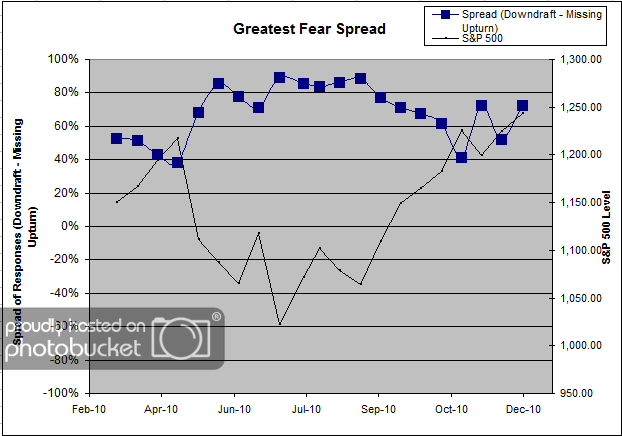

Chart 1: Greatest Fear. From survey to survey, the S&P 500 gained just over 1%. Surprisingly, client fear levels actually moved higher, where we would expect a drop-off in fear levels due to a rising market. We’ll accept the data as is, and partially attribute the unexpected move to the holiday season and lower participation rate. Or, we could also view it as a technical divergence (we would expect falling fear levels with rising prices). This round, 86% of respondents were fearful of a downdraft, up slightly from last round’s reading of 76%. On the flip side, only 14% of respondents were worried about missing an upturn, versus last survey’s reading of 24%.

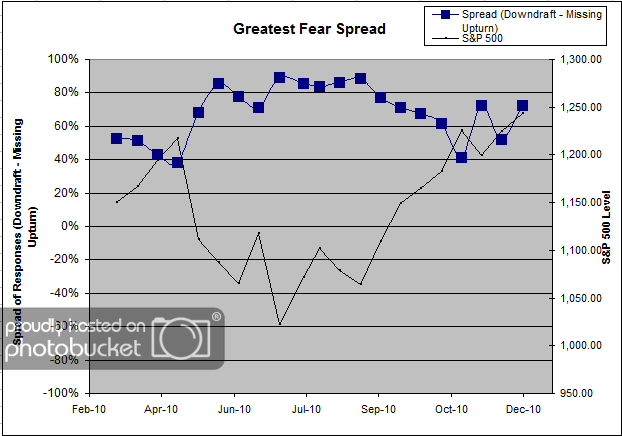

Chart 2. Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread remains skewed towards fear of losing money this round. This round, the spread rose from 52% to 72%, on account of rising fear levels.

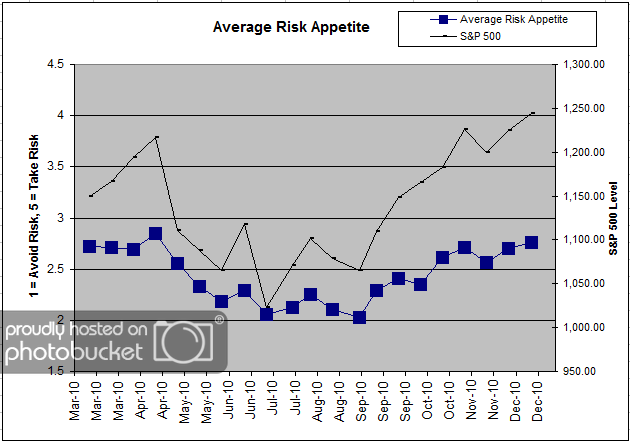

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

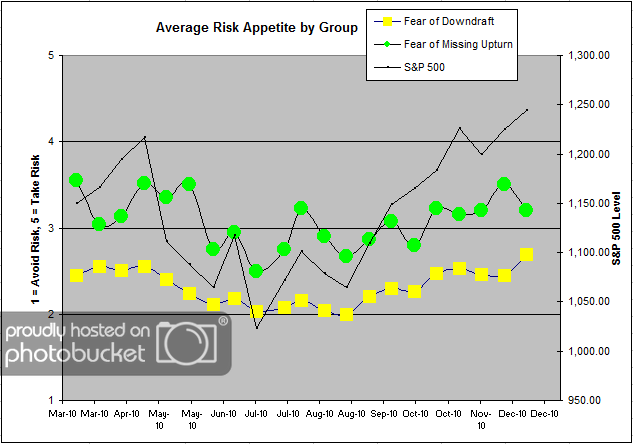

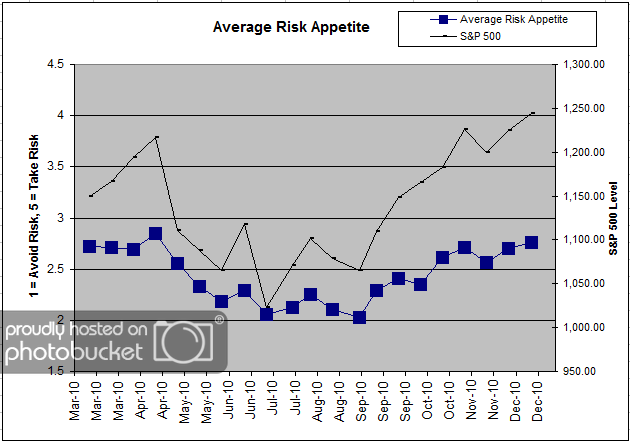

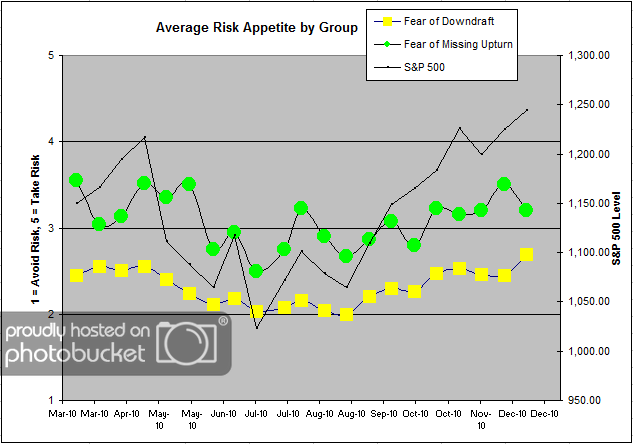

Chart 3: Average Risk Appetite. Unlike the general client fear levels, the average risk appetite moved higher with market, as we would expect it to do. Average risk appetite moved to the highest levels since April, at 2.76. Keep in mind that three surveys ago (11/5), average risk appetite hit 2.71, so we would not consider this a massive breakout. Rather, we’re seeing that client risk appetite is finding the top-level of its current range and barely testing it. It’s good to see this indicator working as we hypothesize, unlike the overall client fear levels this round.

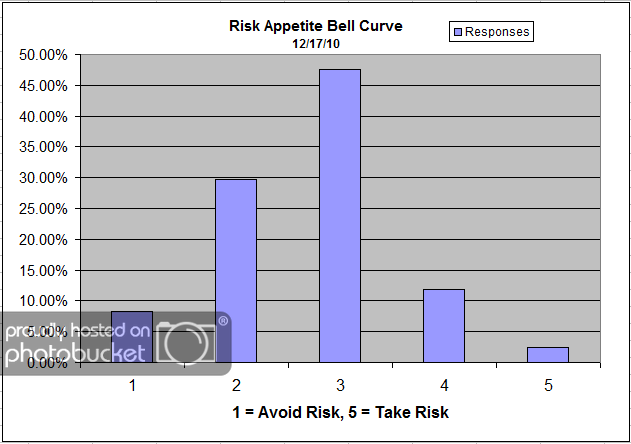

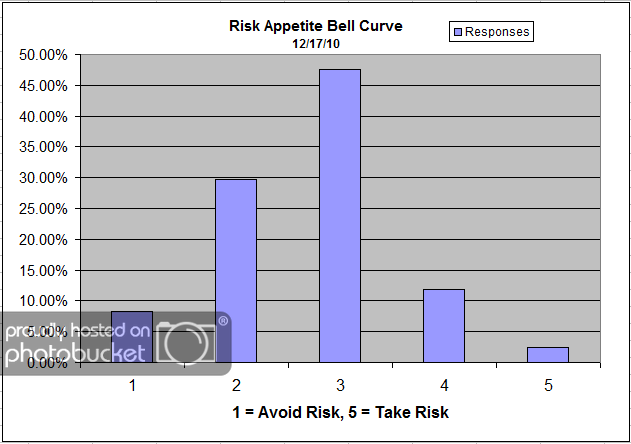

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. The most common risk appetite was 3 this round, with nearly half of all survey respondents.

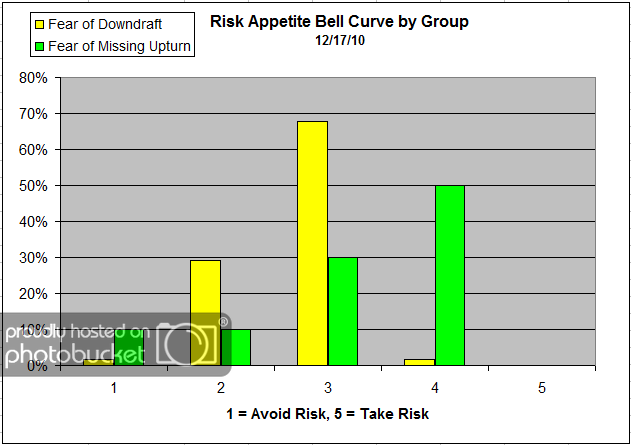

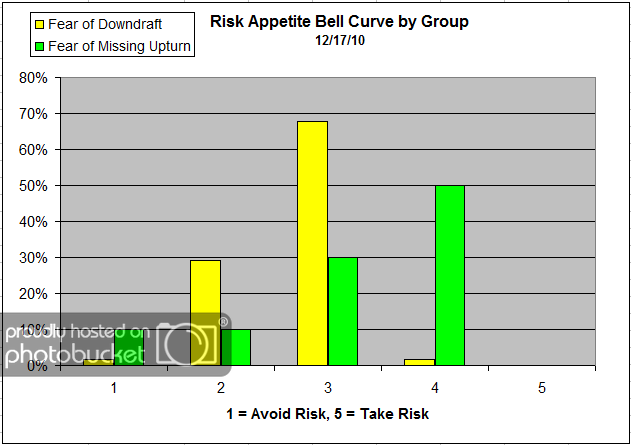

Chart 5: Risk Appetite Bell Curve by Group. The next three charts use cross-sectional data. This chart plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. We would expect that the fear of downdraft group would have a lower risk appetite than the fear of missing upturn group and that is what we see here.

Chart 6: Average Risk Appetite by Group. We’re seeing more deviant behavior from our respondents in this chart. With a rising market, we would expect that both groups have a rising risk appetite (also consider that the overall average did move higher this round). However, the fear of missing upturn group, which has historically shown more volatility in this area, actually moved lower with a rising market. The fear of downdraft group’s average, on the other hand, moved to all-time survey highs. No matter how you slice it, the fear of downdraft’s group move higher is a statistically significant breakout. This round, the fear of downdraft group’s average risk appetite clocked in at 2.69, up from 2.45, while the missing upturn group’s appetite fell from 3.5 to 3.2. The real question is if these anomalies are due to the holiday season (tryptophan is a dangerous drug, we hear), or are they statistically valid occurences?

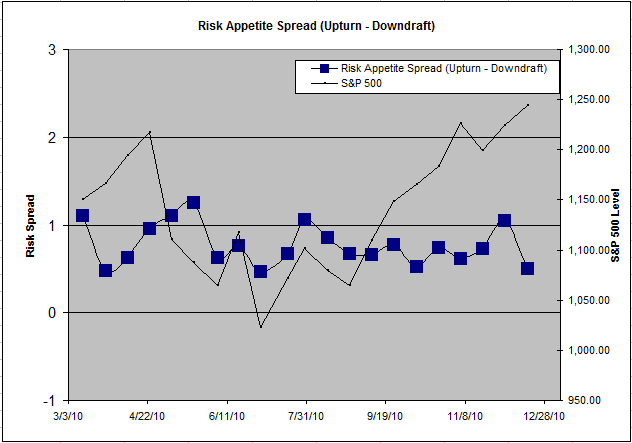

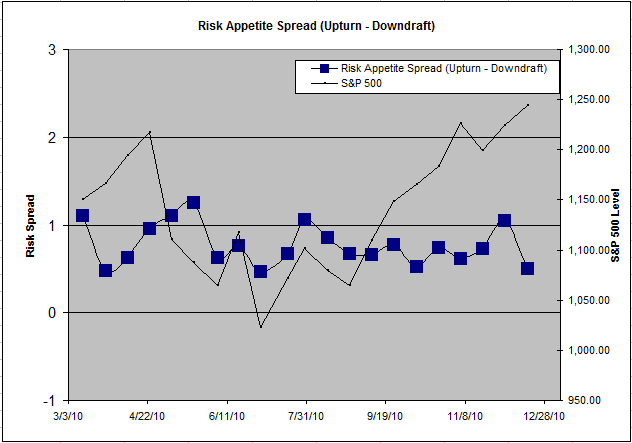

Chart 7: Risk Appetite Spread. This is a spread chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread fell dramatically this round, from around 1.0 to .50. This is due to the sharp moves in risk appetites in both groups’ averages.

We had some interesting moves in some of the indicators this round, and the floor is open to interpretation. Firstly, we saw moderately rising fear levels in a rising market. This flies in the face of what we would expect to see, in addition to what we have consistently seen in the indicator since we started the survey nearly a year ago. Instead of falling fear levels in a rising market, we have rising fear levels in a rising market. Is this just an anomaly, due to anemic holiday response? Or, could this be a technical divergence with investor sentiment forecasting a market drop (Accurate predictions? Ha Ha!)? Either way, it’s nice to have something to think about with our indicators. Usually, they do exactly what they are supposed to, and it’s fun to watch these things play out in real time.

The other story this round would be the fear of downdraft group’s average risk appetite hitting all-time survey highs. What’s doubly interesting about that reading is the fear of missed opportunity group’s risk appetite actually moved lower this round, which we would not expect. All in all, this survey had a couple of interesting nuances, but we’re probably going to see things shake out one way or the other in the first month or two of the new year.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating!