Over the weekend, the Wall Street Journal ran an article on active share. Active shares is essentially how much of a given fund’s allocation is truly active-in other words, how much does it really differ from the benchmark. It turns out that there is quite a strong correlation between high active share and good long-term performance. At the same time, there has been a marked tendency for funds to have lower active share over the past couple of decades. Sadly, more and more funds have embraced the scourge of closet indexing.

We’ve written about active share before, and this new Wall Street Journal article is a welcome addition to the discussion. One of the interesting things to me is why there has been such a rise in closet indexing. I have a couple of hypotheses, but since there is no way to confirm or disconfirm them directly, you’ll just have to determine for yourself if they make sense.

1) The rise of consultants who want low-tracking error. Portfolio managers have a choice—they can reduce their tracking error or they can watch the business go to another firm. Typically, they choose to retain the business, but investors potentially suffer.

2) The rise of wussy investors. If you read stock market books from a generation or two ago, stock market operations were considered speculation. You could make money, potentially a lot of money, but it wasn’t considered to be the safest thing in the world. Stock market traders embraced their roles as speculators. Savers put their money in banks, not in the market. Since the rise of modern portfolio theory, the whole emphasis has been on investing to get higher returns with less risk. We’ve gone from intelligent speculation to The Intelligent Investor. Returns were deemed to be practically assured if you followed the orthodoxy. The entitlement mentality has now taken hold, with investors often feeling quite offended if they don’t make a 10% annual return, especially if they have strategically allocated their investments in the academically approved way. News flash, cupcakes—the market doesn’t work that way! You have to battle for everything you get in the market. If you want a ”guaranteed” return, buy a U.S. Treasury bill and hope the government gets their spending under control before it’s too late.

Active share research points out the truth of the markets. The funds with the best returns have the highest active share and the biggest tracking error. If you want to make money, you have to take the chance that you’re going to deviate a lot from the benchmark—sometimes profitably, other times not.

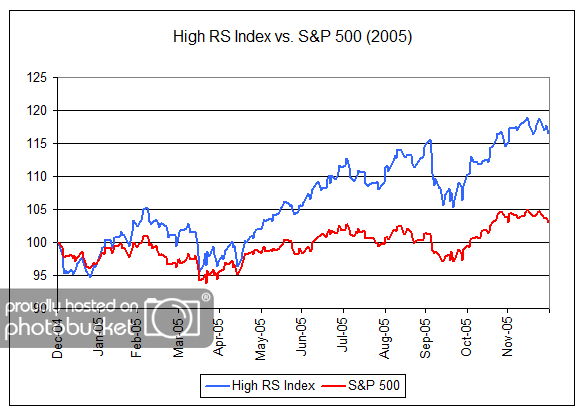

Here’s the good news: since so few investors are willing to go out on a limb, I think the prospects of focusing on a valid historical return factor and making good returns in the long-run are actually quite good. It’s not a crowded trade right now. We think relative strength is one good way to do it, but value can also be mixed in nicely.

[Note: the current level of active share versus the S&P 500 benchmark in our Systematic RS Aggressive (Core) portfolio is over 93% (94%). Active shares below 60% are considered closet indexing. We think our high active share bodes well for long-term returns.]

Posted by Mike Moody

Posted by Mike Moody