CNBC.com has an interesting article about consumer product inflation. CNBC remarks:

According to research from Consumer Reports, many companies have been shrinking the size of the products you buy, while charging the same amount for the product.

Check out the table below from the article. Shrinking the product while maintaining the price is just a hidden price increase—and those are not small price increases! It’s kind of hard to square with the official inflation reports, which indicate there is no inflation.

| Product | Old Size | New Size | Difference |

| PepsiCo’s Tropicana orange juice | 64 oz. | 59 oz | -7.8% |

| Procter & Gamble’s Ivory Dish Detergent | 30 oz. | 24 oz. | -20% |

| Kraft American cheese | 24 slices | 22 slices | -8.3% |

| Kirkland Signature (Costco) paper towels | 96.2 sq. ft. | 85 sq. ft. | -11.6% |

| General Mills’ Haagen Dazs ice cream | 16 oz. | 14 oz. | -12.5% |

| Kimberly-Clark’s Scott toilet tissue | 115.2 sq. ft. | 104.8 sq. ft. | -9% |

| Combe’s Lanacane | 113 grams | 99 grams | -12.4% |

| Chicken of the Sea Salmon | 3 oz. | 2.6 oz. | -13.3% |

| Heinz’s Classico Pesto | 10 oz. | 8.1 oz | -19% |

| ConAgra’s Hebrew National Franks | 12 oz. | 11 oz. | -8.3% |

Source: CNBC, Consumer Reports

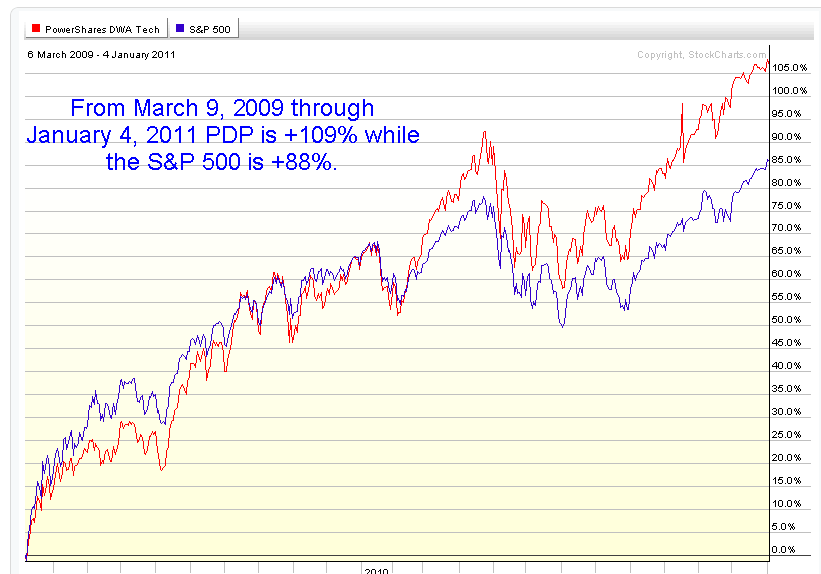

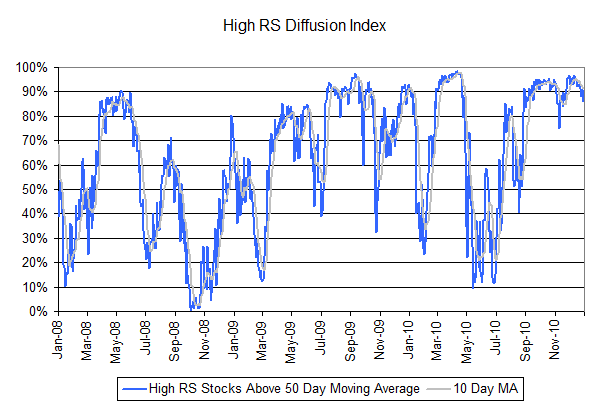

The financial markets are rarely fooled as easily as government statisticians. Keep an eye on relative strength, which will likely be able to sort out the inflation winners and losers.