From Global Economic Analysis, a federal look at what is a global phenomenon.

Source: Global Economic Analysis, Congressional Budget Office

Here is the operative problem:

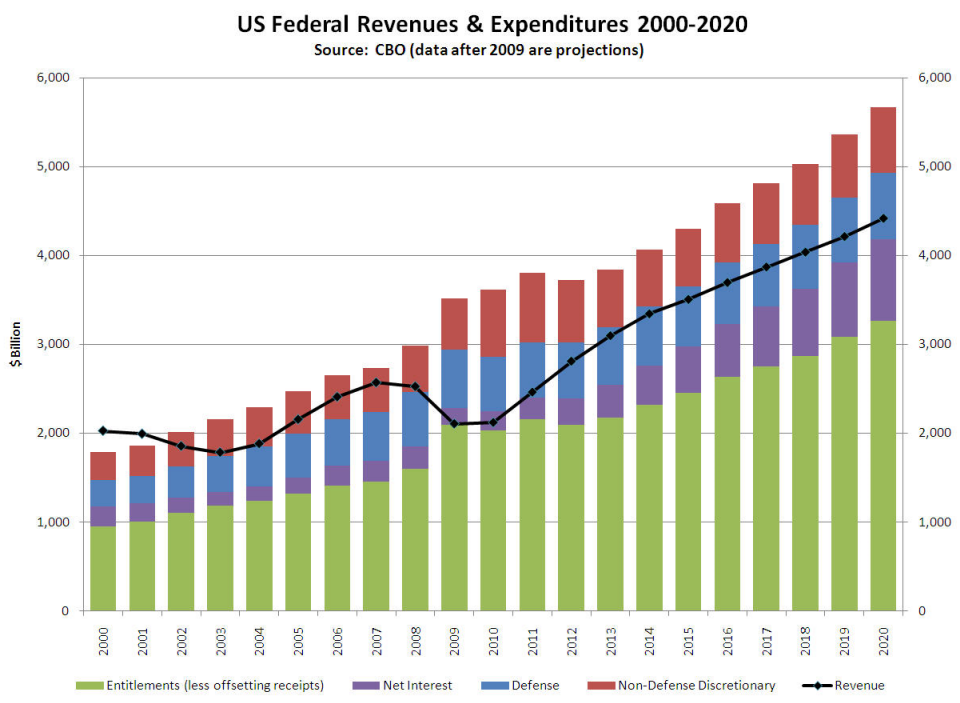

The main point is from now until 2020, we could eliminate 100% of all federal non-defense discretionary expenditures and still run a deficit.

In other words, cutting out waste, fraud, and abuse will fall way short. Entitlement programs will need to be cut. And while entitlement programs are the biggest part of the federal budget, debt service is a rapidly growing slice too.

This process is playing out in developed economies everywhere-Greece, Ireland, Portugal, Japan, Illinois, California, and the entire United States. Some places will choose to keep right on spending; others will choose austerity. These choices could have dramatically different effects on currencies, growth, and ultimately, financial solvency.

Emerging market countries have defaulted on some of their obligations from time to time in recent memory, but the experience of developed economies being consumed by debt is something new to most of us-new even to economists. In the U.S., there is still a vociferous ideological debate between professional economists about the correct path forward.

Ken Rogoff and Carmen Reinhart have written about previous debt-fueled fiscal crises. In almost all of them, bailouts were initially required, followed by austerity. If austerity was not imposed, eventually there was some type of default, through partial repudiation of some obligations (like cutting Social Security or state pensions, for example), through inflation, or through outright default.

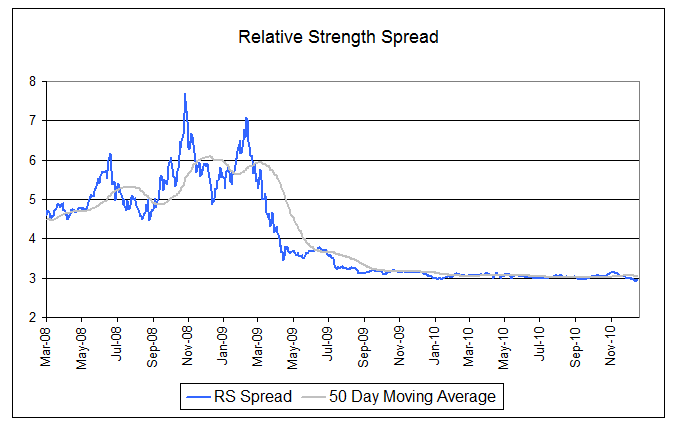

All of these choices will have investment implications. Investors will have to be tactically flexible to simultaneously grow their capital and maintain their purchasing power, all the while attempting to avoid catastrophic losses. Crises create anxiety, but they also create opportunity. The general public is very turned off to equities and risk in general right now, but rising markets will pull them right back in, so the current condition is likely not permanent.

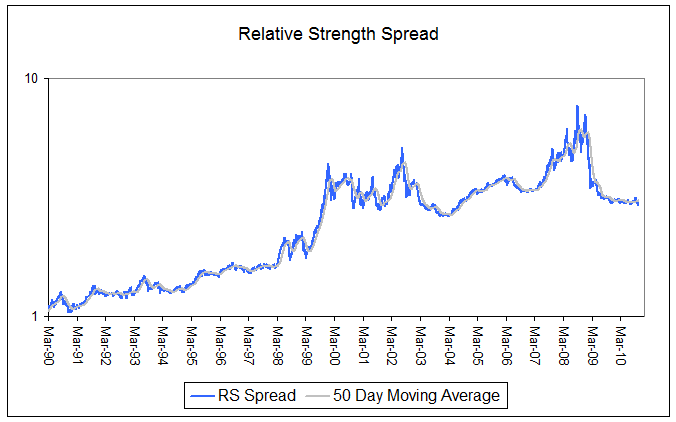

If you have excess capital, you are by definition an investor. How you choose to allocate that excess capital will have a great bearing on your future well-being, so it is imcumbent upon you to make wise choices. Since no one knows what will happen in the future, the decision framework you select is of critical importance. We think that trend-following through systematic application of relative strength is the most robust decision framework available.