From the Boston Globe comes a reminder that the forecaster who was correct about an outlier event is probably a terrible forecaster. From a study by an economist at Oxford they note:

…Denrell and Fang took predictions from July 2002 to July 2005, and calculated which economists had the best record of correctly predicting “extreme” outcomes, defined for the study as either 20 percent higher or 20 percent lower than the average prediction. They compared those to figures on the economists’ overall accuracy. What they found was striking. Economists who had a better record at calling extreme events had a worse record in general. “The analyst with the largest number as well as the highest proportion of accurate and extreme forecasts,” they wrote, “had, by far, the worst forecasting record.”

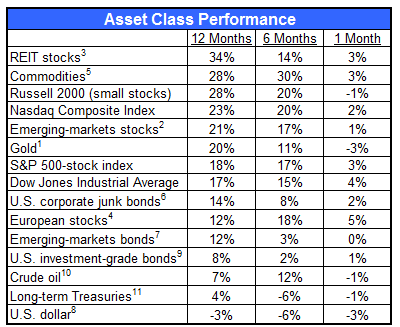

In other words, the extreme forecast gets your attention when it is correct-but you might not notice all of the other, incorrect forecasts that the pundit is making. More productive than making forecasts, we think, is to go where the market has identified leadership. Counting on a lucky forecaster-well, what are the odds of lightning striking twice?