Every NFL team competes every week with one goal in mind: to get to the Super Bowl. No team wins every year, but every team tries to win every year. Like NFL teams, investment managers are a competitive bunch. Each year, about this time, firms wrap up their year-end performance data. We always look to see how we stack up against our direct competitors-some years great, other years not so well.

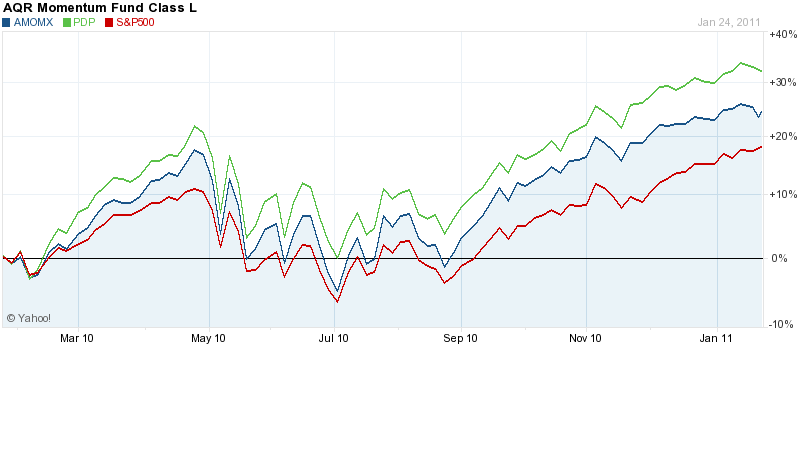

Last year, 2010, turned out to be a very good year for relative strength generally, and especially our relative strength process. The grand-daddy of relative strength indexes, the Technical Leaders Index, performed admirably against both the market and other momentum indexes. While that is unlikely to be the case every year, perhaps we should take the opportunity to do a touchdown dance now!

2010 S&P 500 total return +15.06%

AQR Momentum Index +18.60%

Technical Leaders Index +26.59%

There are some differences between the indexes, of course. The S&P 500 is the de-facto market, containing 500 companies weighted by capitalization. The AQR Momentum Index (AMOMX) contains the top third (about 300 companies) of the largest 1000 by market value. It is ranked by 12-month return and is capitalization weighted. The Technical Leaders Index (PDP) contains 100 companies from the Russell 1000, ranked by Dorsey Wright’s proprietary relative strength measure. The 100 stocks are weighted by relative strength also.

Click to enlarge. Source: Yahoo! Finance

If you compare performance of PDP to QQQQ much of its relative out performance disappears and QQQQ has an approximately 0.5% lower expense ratio.

Dan, interesting, but there’s another point to consider. If and when leadership changes from tech to say energy (for example), then would PDP outperform QQQQ and perform closer to the energy index?

Performance last year for QQQQ was +19.89%, while PDP returned +26.59%. That’s still a 670 basis point advantage in return-and that is net of fees. QQQQ is also substantially more concentrated than PDP. To start with, more than 20% of QQQQ is in AAPL! The top ten holdings are more than 46% of the fund. In contrast, for PDP, AAPL is only a 3.5% weight and the top ten holdings are only about 26% of the portfolio. If anything ever goes wrong with Apple Computer, QQQQ could have a problem. In 2010, a lot went right for AAPL-it was up more than 53%-and even with a 20% weighting, QQQQ did not outperform PDP. That suggests to me that PDP held a large number of monster stocks, not just a couple that had big weights.