Starbucks announced disappointing earnings today. Why? Inflation whacked their margins. According to Clusterstock:

Commodity costs, which are now expected to have an unfavorable impact on EPS of approximately $0.20 for the full fiscal year attributable primarily to higher coffee costs, are reflected in the revised EPS target.

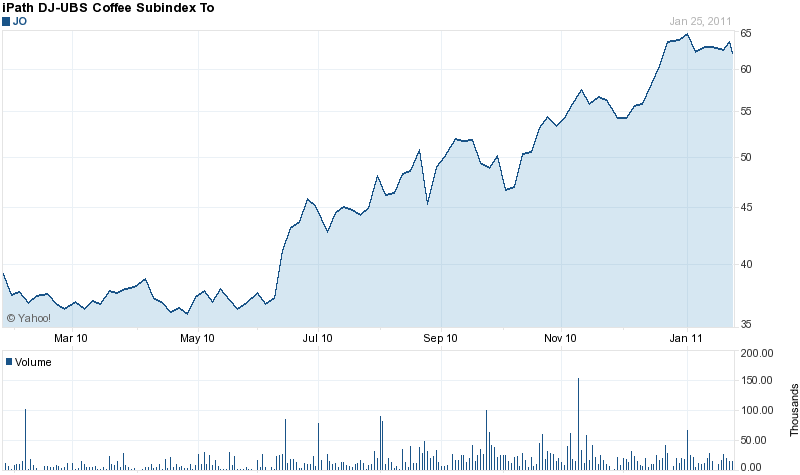

As fast as the price of the mocha frappacino is going up-Starbucks has put through two price increases for their drinks in the last 18 months-their commodity costs are going up even faster. Take a look at coffee prices below.

Source: Yahoo! Finance

Fortunately, there is no consumer inflation according to the government.

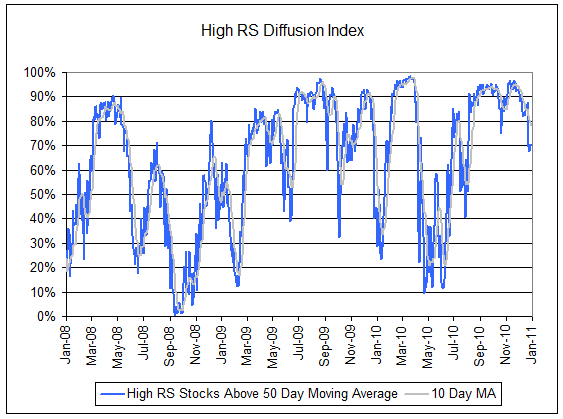

Without some type of disciplined tactical approach to asset class rotation, many investors are going to find it difficult to cope with a high inflation environment if one appears.