Maybe Jeff Reeves is right about small caps versus large caps, maybe he isn’t. All I know is that it is quite hazardous to make any kind of claim based on three years of data. In a commentary in Marketwatch, “Investors Should Never Buy Large Cap Stocks,” this is his thesis statement:

I calculated the returns of both the S&P 500 and Russell 2000 index across the last three years. And for 33 of the past 36 months, an investor putting money into an index fund would have been better served by purchasing the small cap Russell index instead of the S&P.

After a discussion of some of the ups and downs of the last three years, he concludes:

In short, whether the market is about to take a historic flop like it did in 2008, or if it’s poised for a historic run like it saw in 2009, over the long term you are better off buying into small-cap stocks.

Take that advice at your own risk! I’m not sure that three years qualifies as the “long term.” As far as investment horizons go, that’s pretty short. There is some Ibbotson data that suggests that small caps may do better than large caps over the very long term, but that conclusion has always been in dispute. And what’s not in dispute is that markets also go through long cycles of large cap dominance.

Right now, yes, small caps are great. It’s the strongest area in the style box and our relative strength rankings like it too. But this too shall pass, and at some point another asset class or style will be dominant.

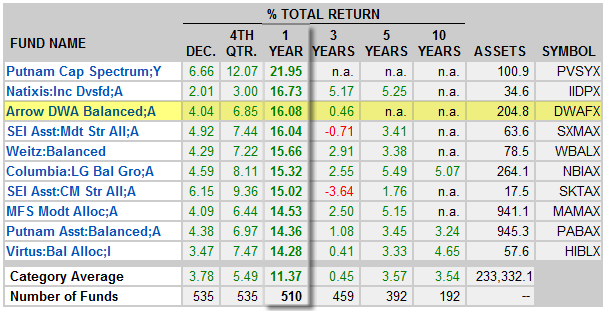

Interestingly enough, Long Term Capital Management, according to Roger Lowenstein’s book When Genius Failed, also based their convergence trades on a three-year database! They thought they had plenty of data because they had actual tick data. Their three-year database didn’t work out too well. This testing process could not contrast more with the testing process used by Dorsey, Wright Money Management. The relative strength factor has an 80+ year record of success and our unique Monte Carlo testing process makes the portfolio results repeatable and robust.

Maybe small caps will outperform from here to infinity and beyond. But I wouldn’t bet on it based on three years of selective data.