Retail investors and hedge funds have taken opposing views on the most recent stock market correction. Clusterstock has a short post on what Global Macro hedge funds did during the dip (click here for the original post). The graph below (taken from the original Clusterstock post) was produced by BofA ML and shows net exposure to the S&P 500 Index for Global Macro Hedge Funds.

(Click To Enlarge)

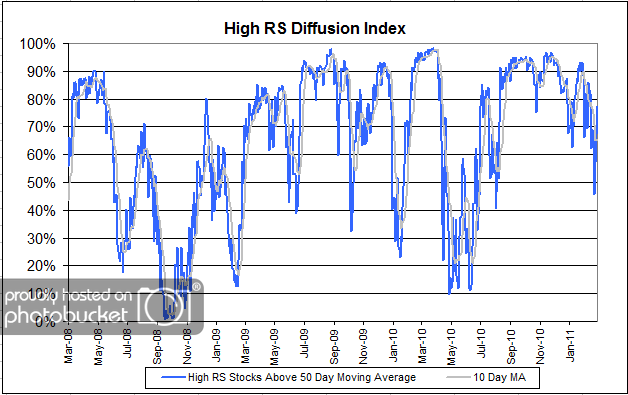

You can see spike up in long exposure to equities over the last month. Our own sentiment survey (the full results of the most recent survey can be seen here), and the most recent AAII survey both show retail investors have become more bearish over the last month. These two surveys don’t measure actual exposure like the BofA survey does, but I think it is safe to assume that retail investors are not increasing equity exposure while they are becoming more bearish on stocks.

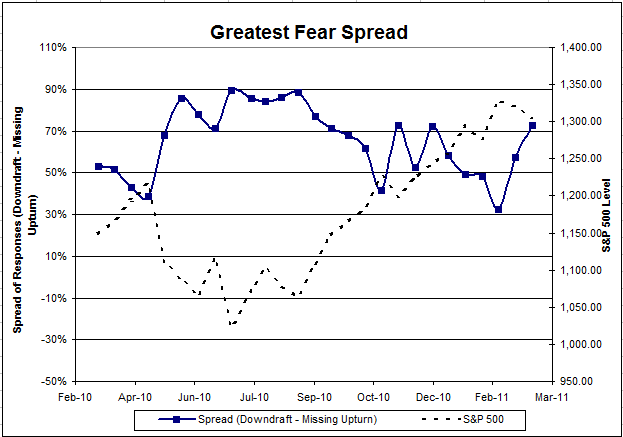

(Click To Enlarge)

In our survey we ask financial professionals whether their clients are becoming more fearful. As equities rallied, their clients became less worried about a downturn. But as the S&P 500 corrected over the last month their clients became more worried about getting caught in a downdraft.

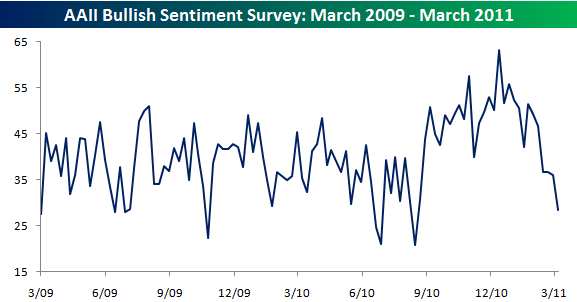

The AAII poll asks individual investors directly whether they are bullish or bearish. This chart was taken from Bespoke and clearly shows individual investors became more bearish very quickly during the decline.

Only time will tell which group is correct. However, I think it is a positive sign for equity markets that there are large pools of money ready to move into stocks during very small corrections. It is also a positive sign that not everyone is buying the dips! When everyone is excited to buy dips you are often closer to a top than a bottom.

Posted by John Lewis

Posted by John Lewis