The Technical Leaders Indexes are indexes created by Dorsey Wright Money Management and are constituted with high relative strength securities from a given universe. We currently run three indexes: Domestic mid to large cap equity, Foreign Developed Markets Equity, and Emerging Markets Equity. These three indexes are licensed by PowerShares and can be purchased in an ETF format (Tickers: PDP, PIZ, PIE).

We are expanding the number of indexes we create. We are adding two more indexes to the Technical Leaders family. (Please note that these indexes are not licensed by any ETF sponsor so there is no vehicle to purchase them directly.)

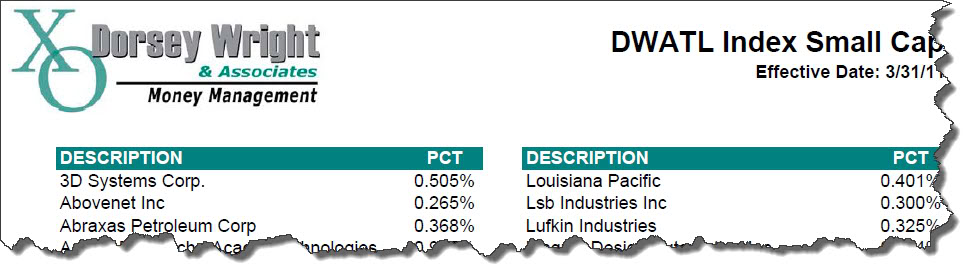

One of the new Technical Leaders indexes will cover the Domestic Small Cap space. All of our other indexes are constituted with 100 securities, but the Small Cap Technical Leaders Index will have 200. This will still allow us to select the top decile from a small cap index like the Russell 2000, while keeping liquidity constraints in mind. To see a list of the current constituents you can click here:

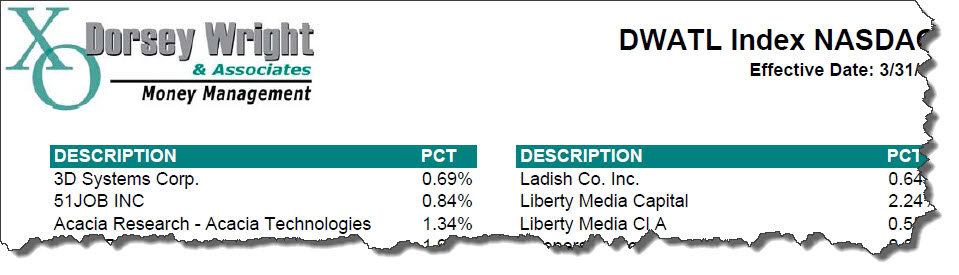

The second index we are beginning to publish tracks 100 high RS securities traded on the NASDAQ exchange. As you can imagine, the selection process will pull out a lot of emerging growth companies so we think this index will be very interesting to follow. For a list of the current constituents you can click here:

Over the next couple of days I’ll post some more information about what is in the indexes. If you have any questions feel free to post them in the comments section and I’ll try to respond to them.

Posted by John Lewis

Posted by John Lewis