Maybe I’m overstating the case slightly, but I will note that buying the dips is a favorite strategy of retail investors. They feel like sophisticated contrarians going against the grain. How better to get street cred as a value investor?

Professionals, on the other hand, have other names for this strategy, replete with terms like knife catching, javelin catching, and catching the falling safe.

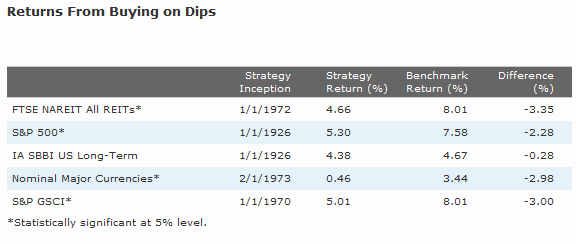

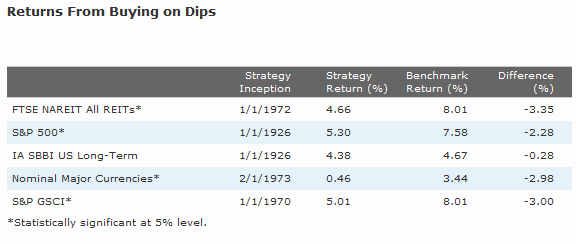

Morningstar puts to rest, hopefully for good, the dubious wisdom of trying to be a knee-jerk contrarian. The results were decidedly negative. Sorry, all you javelin-catchers:

As you can see in the table below, buying the dips hurt returns in stocks, real estate, and currencies, but not long-term U.S. government bonds. The losses are big and exceedingly unlikely to be random events. An investor who bought the S&P; 500 on dips and sold into rallies would have lagged the benchmark by 2.3% annualized since 1926. The chance of suffering such underperformance by randomly selecting months to buy the index is less than 1%.

Source: Morningstar (click to enlarge)

A Suffering Retail Investor

Source: www.writers-free-reference.com

Ouch. So how does that happen? If something is a value, isn’t it supposed to be better when it falls in price? Yes—if you’ve worked up the proper valuation—which is a tricky thing not easily done. And bear in mind:

It’s possible for an asset to shed dollars and still be overpriced.

This isn’t surprising in light of momentum (aka relative strength), according to Morningstar:

The pervasive underperformance of our short-term dip-buying strategy isn’t surprising to those familiar with price momentum (sometimes abbreviated MOM in academia). The tendency for prices to trend can be tremendous. In 1993, Narasimhan Jegadeesh and Sheridan Titman published a study showing that holding the top 10% of U.S. stocks ranked by trailing 12-month returns and shorting the bottom 10%, rebalanced and reconstituted monthly, earned excess returns of 1% a month from 1965 to 1989, or more than 12% annually. The study spurred a frenzy of research that documented momentum in virtually all stock markets and asset classes, including the Victorian-era British stock market. Thanks to this rich body of research, we have a decent idea of why momentum exists and how it behaves.

To be fair, professional investors who are building valuation models often get it right, especially over a long time frame. But I’ve yet to see a retail investor work up a valuation spreadsheet. And without one, you’re probably going to get nailed:

If you’ve done the hard work of calculating an asset’s intrinsic value, and dips bring the price below intrinsic value, the strategy is a rational exercise in value investing. However, without that legwork, dip-buying is a remarkably bad technical trading rule.

I added the bold. If you are a retail investor without a valuation spreadsheet it seems a little dangerous to compete with the professionals by trying to buy the dips.

The point is, if you are going to try to trade technically, it seems far more rational to focus on relative strength. Relative strength works across virtually all markets and asset classes and has done so for a remarkably long period of time. The trend is your friend, until it ends.