Commodity prices have been in decline lately. Inflation is off the table. The inflation trade’s sudden disappearance apparently caught a few Wall Street firms off guard as well. However, an Advisor One article suggests that advisors not be so quick to dismiss inflation as a possibility.

PIMCO’s Mihir Worah says that it’s time to wake up and understand the new dynamics affecting inflation in 2011 and beyond, which he explained in a commentary piece for the fund group on Monday. Overall, he expects inflation to average between 3% and 5% a year worldwide.

Worah (left) says “the goldilocks days of the ’90s,” when countries could have both strong economic growth and low inflation at the same time “are gone.” While in the ‘90s and afterward, emerging markets could export disinflation to developed markets, the situation today is “turning around” as emerging markets go through “a particularly commodity and energy intensive phase of growth,” the portfolio manager explains.

“Inflationary pressure from commodities will be even higher within emerging markets … [since] commodities are such a large part of their consumption basket – for example, nearly 60% in India, compared to about 25% in the U.S.,” he wrote in an opinion piece released by PIMCO on June 27.

“Rising commodity prices along with reflationary policies from many developed-market central banks should result in modestly higher inflation going forward,” Worah added. “We expect developed market inflation to average about 3% and developing market inflation to average about 5% over the secular horizon.”

If Mr. Worah is correct, it’s going to be important to figure out ways to deal with secular inflation in client portfolios. Many advisors working today simply do not remember the 1970s, when the US had its last bout of secular inflation. Investors have the tendency to extrapolate what has been happening lately far into the future—and that rarely works. Often, price changes carry within them the seeds of their own destruction. For example, rising oil prices often lead to slower economic growth, which then leads to weaker oil prices due to falling demand.

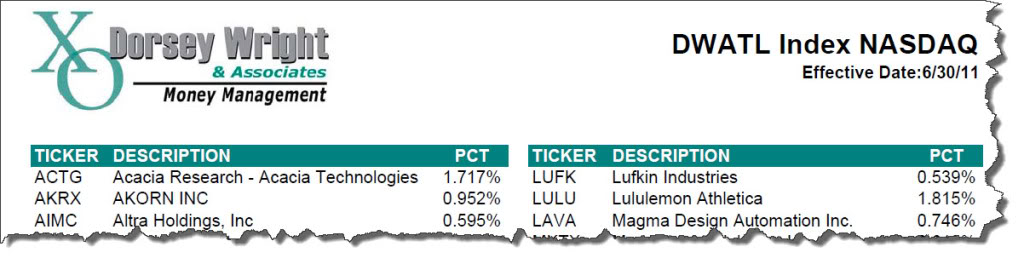

Because price levels are so dynamic, I think it is important to allow the portfolio to adapt tactically to the changes in the markets. Relative strength is one very good way to accomplish that. Incorporating inflation-sensitive assets into the investment universe and then having a disciplined process to manage them tactically could be important to investment results if a secular inflation forecast proves correct.