Click below for our review of the second quarter and our take on why this is likely a good environment to add to relative strength strategies.

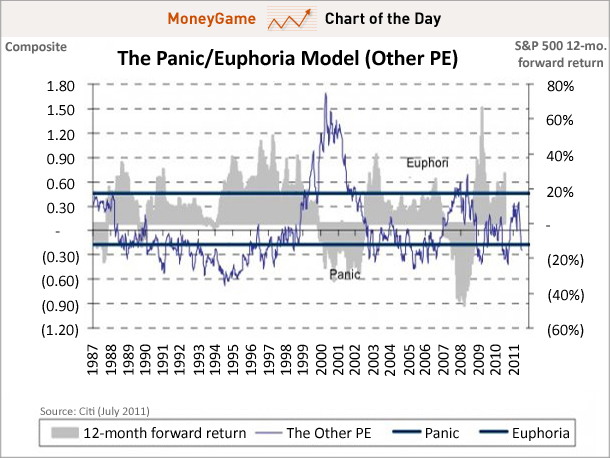

Chart of the Day: Sentiment and Market Rallies

July 5, 2011Clusterstock posted a great chart today, courtesy of Tobias Levkovich at Citi. What we’re looking at is a proprietary measure of market sentiment, coupled with a forward-looking market return of 12 months. Despite a major market rally, investors are still freaked out!! And, going by the looks of this chart, and our more-limited survey data, this could bode well for the market in the coming year.

Again we ask…how long will the market rally before investors feel confident enough to jump on board? Only time will tell.

(click to enlarge)

Posted by: JP Lee

The Coming Debt Hurricane

July 5, 2011Research Affliliates’ Rob Arnott was the subject of a recent article on Marketwatch, ably written by Jonathan Burton. He discusses what he believes is the actual debt situation—we have much more than most people realize—and discusses investment strategies to cope with the debt hurricane going forward. You can read the whole article for his take, but his short list is as follows:

1) Dump traditional asset allocation.

2) Buy inflation-linked bonds.

3) Stock up on commodities.

4) Embrace emerging markets.

5) Reach for high-yield bonds.

Other heavyweights like Bill Gross of PIMCO have talked before about the problems with the traditional 60/40 policy portfolio. What these market mavens are getting at, I think, is that your portfolio construction process needs to be more flexible to deal with risks and opportunities. I agree with this, whether you are constructing your own portfolio pieces or using an all-in-one tactical solution like the Arrow DWA funds (DWAFX, DWTFX) that incorporate a wide variety of global asset classes. The markets are global and your portfolio construction process needs to reflect that.

To obtain a fact sheet and prospectus for the Arrow DWA Tactical Fund (DWTFX) or the Arrow DWA Balanced Fund (DWAFX), click here.

Posted by: Mike Moody

Weekly RS Recap

July 5, 2011The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and quartile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (6/27/11 – 7/1/11) is as follows:

What a week! The market was up big last week, led by high relative strength stocks.

Posted by: Andy Hyer