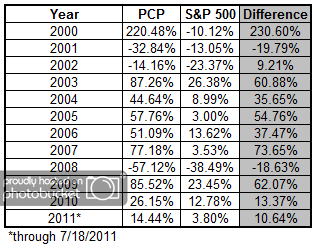

When you find yourself in a deep hole, it is generally a good idea to stop digging. Many countries around the world have already had their ability to repay their debt called into question. As a result, they have made steep cuts in their level of debt issuance, as you can see in the chart from Clusterstock below:

(click to enlarge) Source: Clusterstock

Whoops! In fact, the chart show exactly the opposite. Asset-backed issuance has decreased—fewer mortgages these days—but corporate issuance has increased and sovereign issuance has exploded. Austerity has not been embraced on a global scale at all. Governments are still spending money they do not have available and covering the deficit with borrowed money.

Markets know that such spending is unsustainable, but don’t know exactly when any particular borrower will hit the wall. When lenders eventually refuse to extend credit out of concern the debt will never be paid back in full, austerity will be imposed externally. Sovereigns will have to cut back because no one will lend to them, or will lend only at unrealistic rates. Greece clearly can’t pay 30% rates; the price of the debt is simply indicating that someone is going to take a haircut. Stay tuned to see who gets shaved and how badly—and watch market pricing for the clues.