One of the main reasons that price momentum (aka relative strength) strategies have not been arbitraged away is because most of us are naturally born and bred contrarians. It’s just not in our psychological make-up to want to buy something that has already gone up in price, despite the fact that that is exactly what research tells us we should do. Therefore, those managers who are able to execute a relative strength strategy in a systematic fashion are in a position to do something that would likely otherwise be impossible.

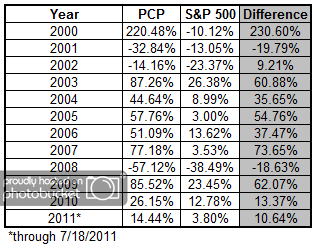

As an example, consider the performance of Precision Castparts (PCP) from 12/31/1999 - 7/18/2011. With a cumulative performance of 2,390% (compared to -11.15% for the S&P 500), PCP is among the best performing stocks in the S&P 900 over this time.

Honestly, without a systematic process in place, wouldn’t it have been psychologically difficult to buy PCP after many of the blowout years over this period? After all, it had already run up so much…

Disclosure: Precision Castparts is currently a holding in the PowerShares DWA Technical Leaders Index (PDP)