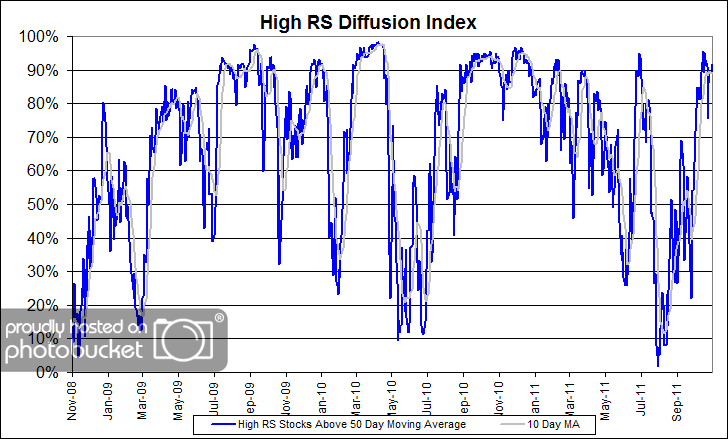

Bespoke Investment Group had a nice note the other day on something that has largely been overlooked amid the ongoing Euro-panic:

While economists and the media are busy debating over whether or not the US economy is in or on the verge of a double dip recession, US companies are busy posting record earnings. According to S&P, with 88.1% of US companies having reported, Q3 operating earnings are on pace to total $25.42 for the S&P 500. On a four quarter trailing basis, earnings for the S&P 500 are set to total $94.77, which would eclipse the old record of $91.47 set in Q2 2007.

Yep, earnings matter-and they’re about to set a new record. Market valuation is simply earnings times some multiple. The earnings multiple can vary widely, of course, depending on investors’ optimism or pessimism. It was explained to me long ago that a P/E ratio is really a psychological indicator and should be renamed Price-to-Expectations Ratio. Our own surveys suggest that investors have very little risk appetite at this time, so one would expect the earnings multiple to be relatively low, which it is.

Source: Bespoke Investment Group

Isn’t it nice to see a chart of something going up for a change? It’s difficult to even guess when investor sentiment will change, but when it does, it’s nice to see that some real earnings growth has gone on beneath the surface.