I noticed another article on alternative beta indexes in Advisor Perspectives the other day. In it, Jason Hsu of Research Affiliates extols the virtues of a variety of alternatively constructed indexes. He concludes:

While the Fundamental Index strategy remains very close to our heart, we are very encouraged by the increasing innovation in the field of alternative betas. Despite often very different approaches, their respective results validate the entire idea of deviating from the binary active–passive world of the past. Some of the most compelling attributes of both are embedded in alternative betas. Like active managers, these methods can produce excess returns and produce different market exposures than mainstream indices, resulting in lower volatility and increased Sharpe ratios. Like traditional indices, most will have lower management costs, many will have similarly skinny implementation costs, and all will have lower governance/monitoring costs than active strategies. Furthermore, some of the most scalable approaches efficiently capture the value and small-cap effects without the long/short requirement, monthly maintenance, and illiquidity of a true Fama–French implementation.

Most investors make their biggest bets on equities, comprising more than 50% of their asset allocation. Accordingly, they have sought to diversify risk within equities by style, size, and geography. We assert that investors should go to greater lengths to diversify their equity portfolio. The past 10 years have brought considerable pain to both sides of the equity active–passive aisle. The third choice of alternative betas—even the simplest such as Equal-Weighting—would have resulted in a far better outcome. Will history repeat? Nobody knows. However, we think the evidence is far too compelling to ignore. We suggest moving alternative betas up your to-do list.

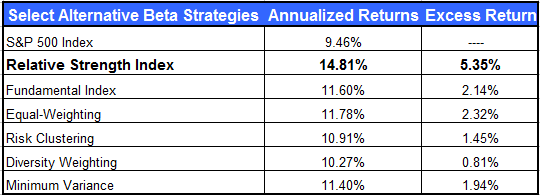

A wide variety of alternative indexes are discussed in the article—with the exception of relative strength. For some reason, no one ever wants to talk about it. However, for your convenience, we are including a table from a prior post that compares relative strength indexing to other methods.

Source: Dorsey Wright Money Management

I understand why proponents of other indexing methods don’t like to discuss it—but it’s a good reason for investors to take a close look at it.