Jeremy Grantham of GMO posits a tension between doing the right thing for the client and getting terminated as a manager. Much of this, he believes, is a function of the client’s patience. He writes in Advisor Perspectives:

Ridiculous as our market volatility might seem to an intelligent Martian, it is our reality and everyone loves to trot out the “quote” attributed to Keynes (but never documented): “The market can stay irrational longer than the investor can stay solvent.” For us agents, he might better have said “The market can stay irrational longer than the client can stay patient.” Over the years, our estimate of “standard client patience time,” to coin a phrase, has been 3.0 years in normal conditions. Patience can be up to a year shorter than that in extreme cases where relationships and the timing of their start-ups have proven to be unfortunate. For example, 2.5 years of bad performance after 5 good ones is usually tolerable, but 2.5 bad years from start-up, even though your previous 5 good years are well known but helped someone else, is absolutely not the same thing! With good luck on starting time, good personal relationships, and decent relative performance, a client’s patience can be a year longer than 3.0 years, or even 2 years longer in exceptional cases. I like to say that good client management is about earning your firm an incremental year of patience.

On the one hand, this is kind of funny from a manager’s point of view because it is something we can all relate to. DALBAR has documented that a client’s average holding period is about three years, and that is exactly the conclusion that Mr. Grantham comes to also. (The bold is mine; I think Mr. Grantham’s twist on Keynes may become a classic.)

On another level, this is very sad. It’s sad that good client management is required to earn an extra year of patience. As an industry, we apparently do a poor job of educating our clients about realistic expectations. If we start a relationship promising sunshine and rainbows, of course the client will be disappointed when the first dark clouds appear. On the other hand, if we warn clients about the inevitability of rain, and the possibility or likelihood of hail, tornadoes, and earthquakes, they are likely to sign up with our sunshine-and-rainbows competitor.

And, honestly, part of the blame may lie with the clients. Many clients want to hear about sunshine and rainbows, not rain and hail. If both are mentioned, they tend to remember the sunshine and rainbows and have only a hazy recollection of anything else.

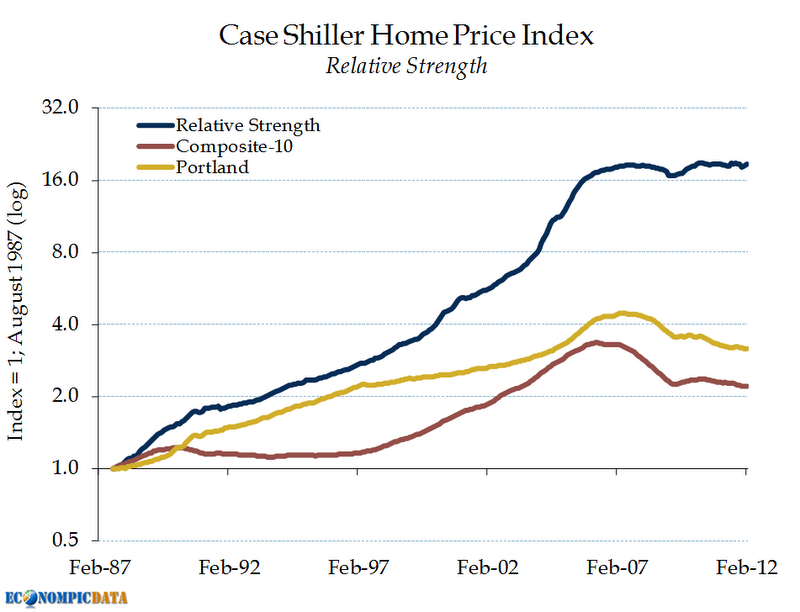

Here’s the problem: return factors, even historically reliable ones like relative strength or value, tend to play out over periods longer than three years. This is why there is such a disconnect between manager returns (NAV returns) and client returns (dollar-weighted returns). I guess if return factors were so uber-reliable that they worked every year, there would be no patience problem. Clients would be happy to sit on their hands and collect the premium.

Unfortunately, collecting on return premiums is a lumpy business. In extreme cases, you can have situations where there are a number of years that go nowhere, followed by all of the excess return in a six-month period. Clients ideally would like to be invested just for those six months, but no one ever knows at what point in the cycle the excess return will occur. This makes it really tough for clients, as they essentially have to make a leap of faith.

The ideal client is one whose “standard client patience time” is infinite. We have a few very long-term clients here that have been with us since 1994, almost twenty years. They’ve moved from capital accumulation mode when they first joined us to distribution mode some years ago. In a couple of cases, they’ve already withdrawn more money than they started with—and still have balances in excess of their original deposit. Every money manager would clone clients like these if they could.

Here’s an interesting thing that Mr. Grantham doesn’t mention: if you talk to any number of advisors, you will find that, inevitably, the clients with infinite patience tend to be the clients with the best performance! I don’t know what twist of karma makes it so, but advisors all know this phenomenon. Clients who can make that courageous leap of faith tend to be rewarded. It’s our job as advisors to allow the clients to feel comfortable doing something that is inherently uncomfortable for them.