Investors frequently rely on market indicators, such as moving averages, to decide when to buy, sell, or hold a stock. In fact we hear all the time of the magical powers of the moving average indicator, which has the mystical capabilities of keeping you out of trouble during market downturns, while making sure you are along for the ride on any rallies.

Therefore, we decided to test performance of Ken French’s High Relative Strength Index (an explanation of this index can be found here) against 50 and 200 day moving averages. We’ve calculated returns based on the assumption that the investor buys or holds when the price of the RS stock is above the moving average, and sells when the price drops below the moving average. So when the index is above its 50-, or 200-day moving average, we are fully invested, and when it’s below, we are out of the index.

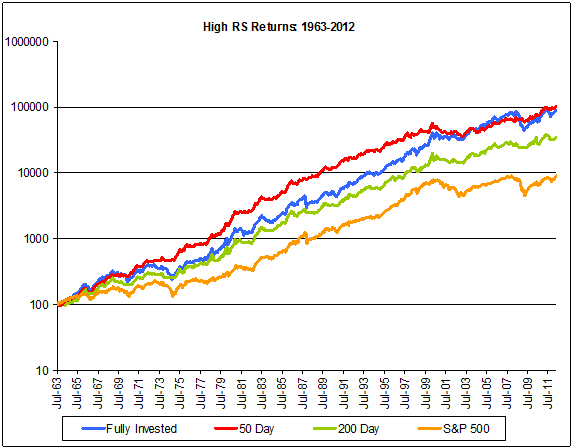

Chart 1: Returns from 1963-2012. During this time period, basing buy and sell decisions off of the 50 day moving average is more successful than being fully invested. It is important to keep in mind that this data includes the bear markets of the 1970s and 2000s.

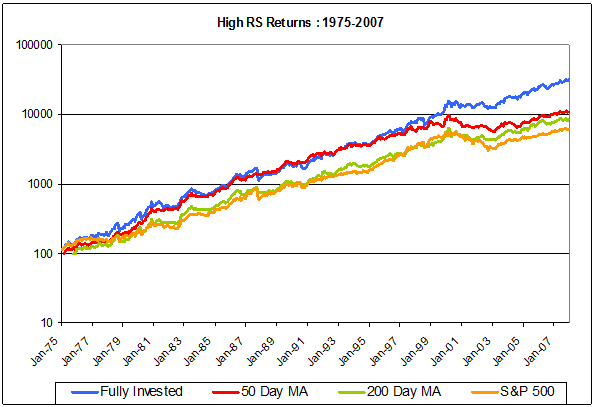

Chart 2: Returns from 1975-2007. When we start at a different point in time, the 50 day moving average performs much more poorly. In this dataset, we’ve cut out two large bear markets, and the effect on returns is drastic. In this case, it would have been better to just buy and hold.

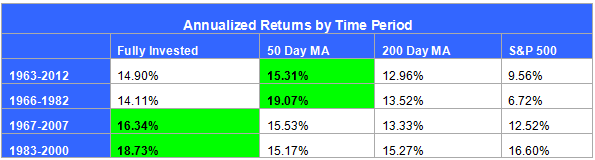

Table 1: Annualized Returns by Time Periods. The average annualized returns also vary based on the period of time measured. At certain times, following moving averages outperforms being fully invested; but in other periods the opposite is true. Check out the difference between the two periods of ’83-’00 and ’66-’82. Using a moving average can either make or break your returns.

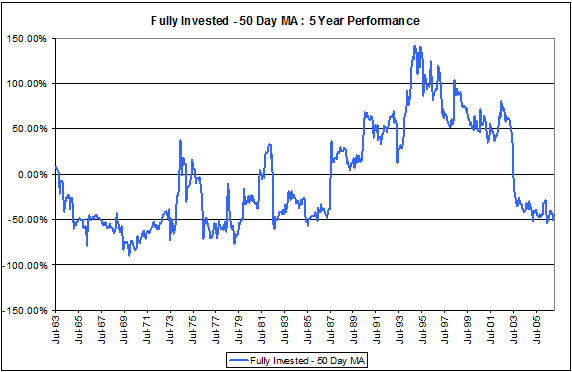

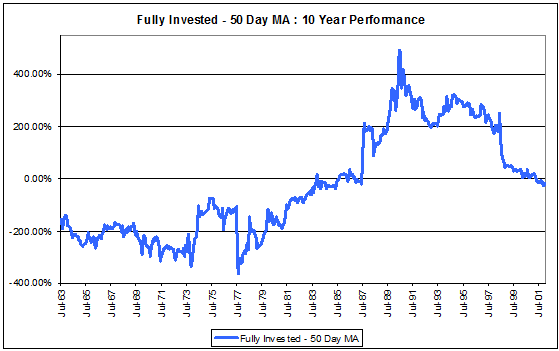

Charts 3 and 4: Fully Invested Ken French – Use of 50 Day MA (5 and 10 Year Performance). Investment performance based on moving averages varies greatly over time. In some periods, it performs incredibly, while in others it does terribly.

The performance of moving average based investment is directly related to the time period in which it is measured. As shown in Table 1, the returns can be completely different even in periods that partially overlap. The question then becomes not whether or not to use a moving average, but when! If you can predict the future, you’ll easily be able to decide whether or not to use a moving average when holding an index.

[...] Does the use of moving averages help relatives strength strategies? (Systematic Relative Strength) [...]

Do you have volatility and max. drawdown numbers for these period studies? A primary goal of using the 200-day moving average (a la Mebane Faber’s work) seems to be to reduce volatility and max. drawdowns and not just increase returns.

Also, would it possible to do these studies using only the 50-day or 200-ay moving average, without layering it on top of relative strength?

The blog is fantastic!

Hi- The standard deviation is about 20% when fully invested and decreases when the moving averages are used (to about 15%). Also, I’ll look into a moving average study based on the S&P500, which I’ll hopefully get to later this summer. Thanks!