Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference—-Reinhold Niebuhr

Serenity is in short supply in the investment community! Capital Group/American Funds recently posted a fantastic commentary on uncertainty, pointing out that investors are much better off if they focus on what they can control and don’t sweat the other stuff. Here are some excerpts that struck me—but you should really read the whole thing.

Powerless. That’s how a lot of investors feel. In a recent Gallup poll, 57% of investors said they feel they have little or no control over their efforts to build and maintain their retirement savings. What’s causing them to feel so lost? According to 70% of those polled, the most important factor affecting the investment climate is something they can’t control, the federal budget deficit.

On the flip side, among investors with a written financial plan having specific goals or targets, the poll showed 80% of nonretirees and 88% of retirees said their plan gives them the confidence to achieve their financial goals. It seems like some investors have figured out what they can control and what they can’t.

Life for investors would be simpler if there were a handy timetable by which these issues would be resolved in a quick and orderly fashion. But successful investors know they can’t control the outcome of the euro-zone summits or American fiscal debates, much less plug politics into a spreadsheet.

They can, however, review their goals, manage risk, be mindful of valuation and yield and remember that diversification may matter now more than ever. It’s easy to overlook in such a challenging environment, but unsettled times can also offer opportunities for long-term investors. In the midst of uncertainty, there are companies with strong balance sheets, smart management and innovative products that continue to thrive, and whose shares may be attractively valued.

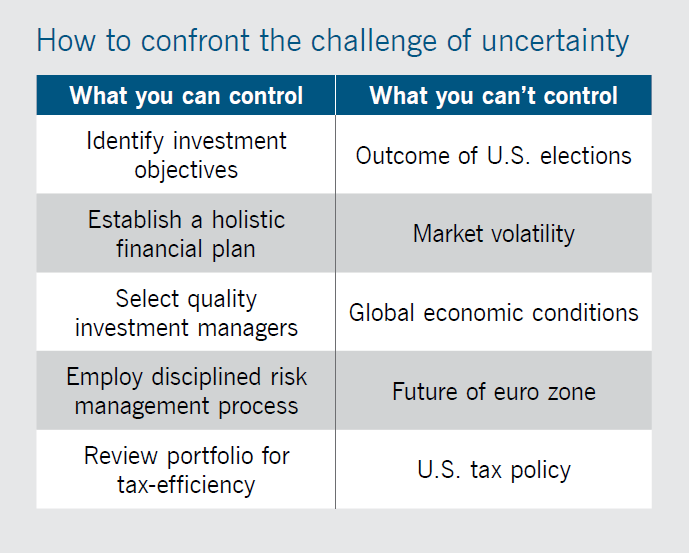

All true! We’ve written before about what an important investment attribute patience is. Maybe in some important way, serenity contributes to patience. It’s hard to be patient when you’re worried about everything, especially things you have no control over! They even include a handy-dandy graphic with suggested responses to all of those things disturbing your serenity.

Source: American Funds Distributors (click on image to enlarge)

At some level, perhaps we are all control freaks. Unfortunately for us, in a relationship with the market, it’s the market that is in control! We can’t control market events, but we can control our responses to those events. Finding healthy ways to manage market anxiety is a primary focus for every successful investor.