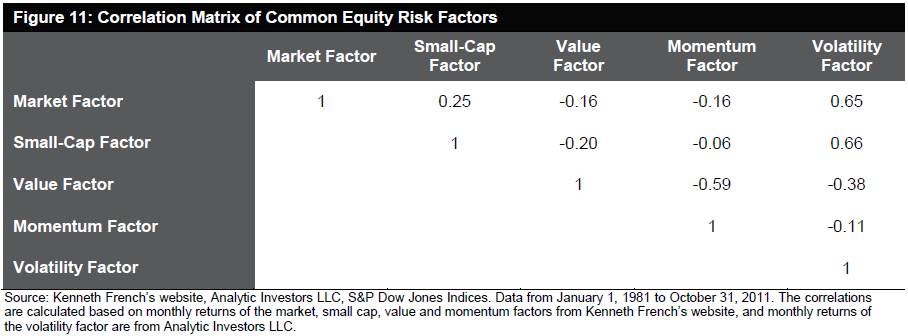

We use relative strength (known as “momentum” to academics) in our investment process. We’ve written extensively how complementary strategies like low volatility and value can be used alongside relative strength in a portfolio. S&P is now on board the train, as they show in this research paper how alternative beta strategies are often negatively correlated. In fact, here’s the correlation matrix from the paper:

Source: Standard & Poors (click to enlarge image)

You can see that relative strength/momentum is negatively correlated with both value and low volatility. This is why we prefer diversification through complementary strategies.

They conclude:

…combining alternative beta strategies that are driven by distinct sets of risk factors may help to reduce the active risk and improve the information ratio.

Diversification is important for portfolios, but it’s not easily achieved. For example, if you decide to segment the market by style box rather than by return factors, you will find that the style boxes are all fairly correlated. Although it’s a mathematical truism that anything that isn’t 100% correlated will help diversification, diversification is far more efficient when correlations are low or negative.

We think using factor returns to identify complementary strategies is one of the more effective keys to diversification.