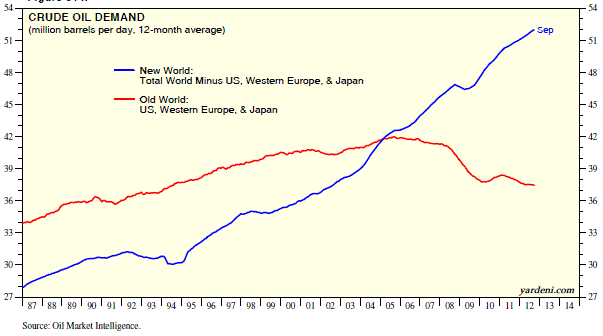

Ed Yardeni of Dr. Ed’s Blog had an interesting chart of oil demand. The interesting part was that he segmented the demand between Old World (US, Western Europe, and Japan) and New World (everyone else). There really is a new world order, something that your portfolio needs to reflect.

Source: Dr. Ed’s Blog (click on image to enlarge)

In this case, a picture might be worth a few thousand words. You can see pretty clearly that the growth rate in oil demand is far higher outside the Old World. Up until 2004, aggregate demand was higher in the Old World, but that has changed too. The big engine of oil demand is no longer the large developed economies. The last recession created a downturn in oil demand in the Old World, but created barely a blip on the chart for the New World. I was surprised when I saw this chart, and I’m probably not the only one. I think most people in the investment industry would be surprised by this—and certainly many clients would be too.

To me, this is a good argument for global tactical asset allocation. Yes, the economy is slow—but clearly not everywhere. Based on oil demand, some economies are growing just fine. Global tactical asset allocation allows you to go where the returns are, regardless of where they may be. Relative strength is a good way to locate those returns.