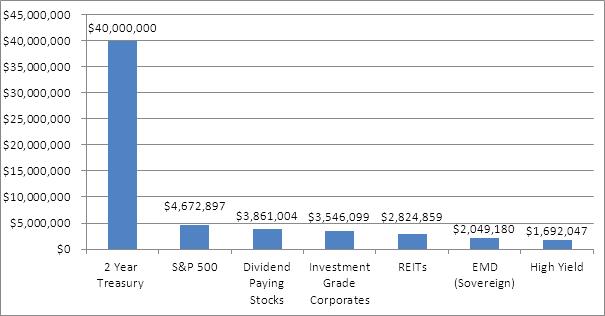

Investors lately are in a frenzy about current income. With interest rates so low, it’s tough for investors, especially those nearing or already in retirement, to come up with enough current income to live on. A recent article in Advisor Perspectives had a really interesting take on current income. The author constructed a chart to show how much money you would have to invest in various asset classes to “buy” $100,000 in income. Some of these asset classes might also be expected to produce capital gains and losses, but this chart is purely based on their current income generation ability. You can read the full original article to see exactly which asset classes were used, but the visual evidence is stunning.

Source: Advisor Perspectives/Pioneer Investments (click to enlarge)

There are two things that I think are important to recognize—and it’s hard not to with this chart.

- Short-term interest rates are incredibly low, especially for bonds presumed to have low credit risk. The days of rolling CDs or clipping a few bond coupons as an adequate supplement to Social Security are gone.

- In absolute terms, all of these amounts are relatively high. I can remember customers turning up their noses at 10% investment-grade tax-exempt bonds—they felt rates were sure to go higher—but it only takes a $1 million nest egg to generate a $100,000 income at that yield. Now, it would take more than $1.6 million, even if you were willing to pile 100% into junk bonds. (And we all know that more money has been lost reaching for yield than at the point of a gun.) A more realistic guess for the typical volatility tolerance of an average 60/40 balanced fund investor is probably something closer to $4.2 million. Even stocks aren’t super cheap, although they seem to be a bargain relative to short-term bonds.

That’s daunting math for the typical near-retiree. Getting anywhere close to that would require compounding significant savings for a long, long time—not to mention remarkable investment savvy. The typical advisor has only a handful of accounts that large, suggesting that much work remains to be done educating clients about savings, investment, and the reality of low current yields.

The pressure for current income might also entail some re-thinking of the entire investment process. Investors may need to focus more on total return, and realize that some capital gains can be spent as readily as dividends and interest. Relative strength may prove to be a useful discipline in the search for returns, wherever they may be found.