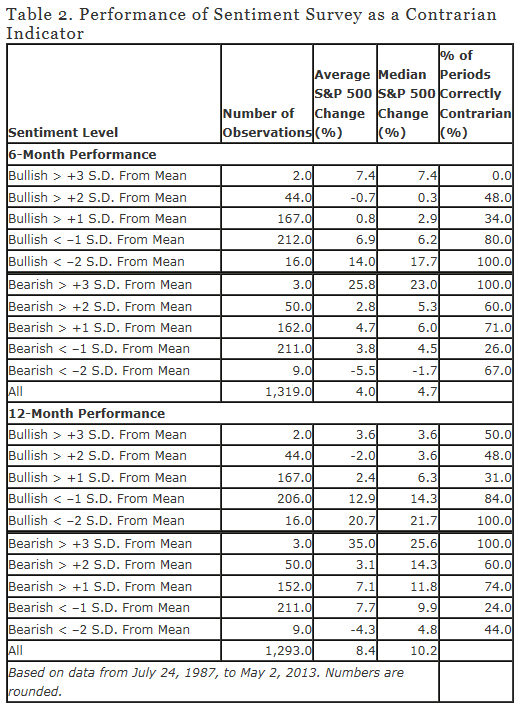

Greenbackd, a deep value blog, had a recent piece on the value of stock market sentiment. Stock market sentiment surveys have been a staple of technical analysis for decades, ever since the advent of Investors Intelligence in the 1960s, so I was curious to read it. The study that Greenbackd referenced was done by Charles Rotblut, CFA. The excerpts from Mr. Rotblut that are cited give the impression that the results from the survey are unimpressive. However, they showed a data table from the article. I’ll reproduce it here and let you draw your own conclusions.

Source: Greenbackd (click on image to enlarge)

From Greenbackd, here’s an explanation of what you are looking at:

Each week from Thursday 12:01 a.m. until Wednesday at 11:59 p.m. the AAII asks its members a simple question:

Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)?

AAII members participate by visiting the Sentiment Survey page (www.aaii.com/sentimentsurvey) on AAII.com and voting.

Bullish sentiment has averaged 38.8% over the life of the survey. Neutral sentiment has averaged 30.5% and bearish sentiment has averaged 30.6% over the life of the survey.

In order to determine whether there is a correlation between the AAII Sentiment Survey and the direction of the market, Rotblut looked at instances when bullish sentiment or bearish sentiment was one or more standard deviations away from the average. He then calculated the performance of the S&P 500 for the following 26-week (six-month) and 52-week (12-month) periods. The data for conducting this analysis is available on the Sentiment Survey spreadsheet, which not only lists the survey’s results, but also tracks weekly price data for the S&P 500 index.

There are some possible methodological problems with the survey since it is not necessarily the same investors answering the question each week (Investors Intelligence uses something close to a fixed sample of newsletter writers), but let’s see if there is any useful information embedded in their responses.

The way I looked at it, even the problematic AAII poll results were very interesting at extremes. When there were few bulls (more than 2 standard deviations from the mean) or tons of bears (more than 3 standard deviations from the mean), the average 6-month and 12-month returns were 2x to 5x higher than normal for the 1987-2013 sample. These extremes were rare—only 19 instances in 26 years—but very useful when they did occur. (And it’s possible that there were really only 16 instances if they were coincident.)

Despite the methodology problems, the data shows that it is very profitable to go against the crowd at extremes. Extremes are times when the emotions of the crowd are likely to be most powerful and tempting to follow—and most likely to be wrong. Instead of bailing out at times when the crowd is negative, the data shows that it is better to add to your position.

HT to Abnormal Returns

Wonderful blog! I found it while browsing on Yahoo News.

Do you have any suggestions on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Many thanks