Dividend investing is all the rage these days. It can be a valuable investment strategy if it is done well—and a very negative experience if it is done poorly. The editor of Morningstar’s DividendInvestor, Josh Peters, recently penned a great column after his model portfolio collected its 1000th dividend payment. The article involves the lessons he learned in his foray into dividend investing. It is a must-read for all dividend investors.

One interesting thing, to me, was that many of the dividend investing problems that he experienced could have been avoided with a relative strength screen. (We use just such a screeen for the First Trust dividend UITs we specify the portfolios for.) Allow me to explain what I mean.

Morningstar’s first lesson was that quality was important in dividend investing. Mr. Peters writes:

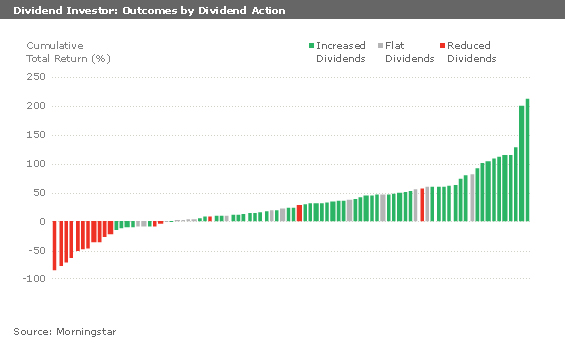

The dividend cutters occupy a land of agony: We lost money on 13 of the 16 portfolio holdings that cut their dividends, and the 3 that have been profitable–General Electric (GE), U.S. Bancorp (USB), and Wells Fargo (WFC)–only pulled into the black long after their dividends began to recover.

One of the first things we noticed when screening the dividend investing universe by relative strength was this: companies that cut their dividends overwhelmingly had negative relative strength. In fact, when I looked through the list of S&P; Dividend Aristocrats that cut their dividends in the middle of the Great Recession, I discovered that all but two of them had negative relative strength before the dividend cut. Some had had poor relative strength for many years. Pitney Bowes (PBI) is just the most recent example. You can see from Morningstar’s chart below that most of their losses came from dividend cutters.

Source: Morningstar (click on image to enlarge)

In other words, screening for good relative strength is a pretty good insurance policy to avoid the land of agony.

Morningstar’s second lesson was that many of the best dividend stocks were not fundamentally cheap.

I’ve always believed dividends were the most important aspect of our investment strategy, but I’ve always been something of a cheapskate, too. I don’t like paying full price for anything if I can help it. In the first year or two of DividendInvestor’s run, I brought this impulse to my stock-picking, but I was often disappointed. In the banking industry, for example, I originally passed on top performers like M&T; (MTB) and gravitated toward statistically cheaper names like National City and First Horizon (FHN).

Guess what top performers have in common? You guessed it—good relative strength. A relative strength screen is also a useful way to avoid slugs that are cheap and never perform well.

The third lesson is just that time is important. If you are doing dividend investing, a lot of the benefit can come from compounding over time, or perhaps from reinvesting all of the yield.

If you choose to use the Dorsey Wright-managed First Trust UITs, we always recommend that you buy a series of four UITs and just keep rolling them over time. That way you always have a current portfolio of strong performers, screened to try to avoid some of the dividend cutters. If the portfolio appreciates over the holding period—beyond just paying out the dividend yield—it might make sense when you roll it over to use the capital gains to buy additional units, in an effort to have the payout level increase over time.

Even if you never use our products, you might want to consider some basic relative strength screening of your dividend stock purchases.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. See http://www.ftportfolios.com for more information.

[…] recent post Relative Strength Dividend Investing highlighted a couple of key ways that relative strength screens have the potential to improve the […]

Fantastic goods from you, man. I have be aware your

stuff prior to and you are simply too excellent. I actually like what you’ve obtained here, really like

what you’re stating and the best way by which you say it.

You are making it entertaining and you still care for to stfay it wise.

I can’t wait to read far more from you. This is really a great site.

The response to this question is that, The apple company iphones or The

apple company ipads have numerous programs that they can access but not all are available or freely offered.

Follow the tutorial here: How to put i - Phone in DFU mode.

You will now be asked to put your i - Phone into DFU mode.

With their top selling products, people always be wary of their latest developments and releases just like the i - Pod, i - Phone,

ipod itouch, i - Pad and Apple TV. This is where reviews and listings of the

best applications out there come in very handy

indeed. Their software is always most currently obtainable and

being easiest to use.

There are a number of must have i - Phone apps that every i - Phone individual need

to have. This is where reviews and listings of the best applications out there come in very handy

indeed. Their software is always most currently obtainable and being easiest

to use.

As the admin of this website is working, no uncertainty

very soon it will be famous, due to its quality contents.

What is an IPSW and why am I being asked for it while jailbreaking my iPod?

Hello Dear, are you genuinely visiting this

site on a regular basis, if so after that you will definitely take good experience.

Yo he tenido y tengo Trastorno de ansiedad generalizado.

Cuando no puedo controlarlo, se convierte en ataques de pánico.

Se pasa fatal, intento respirar y al rato pasa, pero cuando por sorpresa me ataca

ya el pánico es casi imposible controlarlo. Así que tengo que estar alerta

al mínimo indicio de ansiedad. Solo así lo puedo controlar.

Evidentemente, cuando no puedo hacer ya nada por evitarlo, intento serenarme y respirar.

No sé si mi comentario puede ayudar, pero lo más importante es hacer respiraciones al menos

una vez al día. Y que no nos pueda la maldita ansiedad.

In the early days of UNIX the word segments was used in the same way we use files today

(hence ls and not lf. As it becomes easier for the system administrators to

adapt and manage it, Windows virtual private server is considered to provide with good security protection. Windows has dominated

the market for operation systems, vastly outperforming rivals such as Linux and Mac OS and gobbling up the

lion. The distribution cost is the only expense involved

in this type of hosting as it is incurred by the proprietor or the owner.

Great post, I’m going to shell out time researching this topic.