Numerous market observers over the past few years have wondered about the timing of ”the great rotation,” wherein investors would begin to rotate some of their massive bond holdings into the equity market. When would the great rotation happen, or would it happen at all?

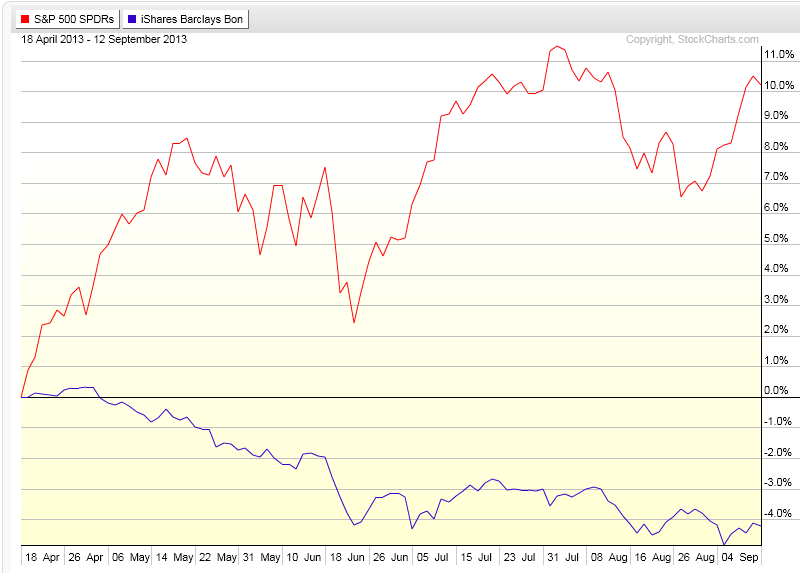

There has been a big return differential in stocks and bonds—much in favor of stocks—since the market bottom in 2009, but that did not convince investors to leave the bond market. Stocks were doing great, but bonds were still going up.

(click on image to enlarge)

It’s only been quite recently that bond total returns have actually been negative. Maybe that will be the straw that breaks the camel’s back.

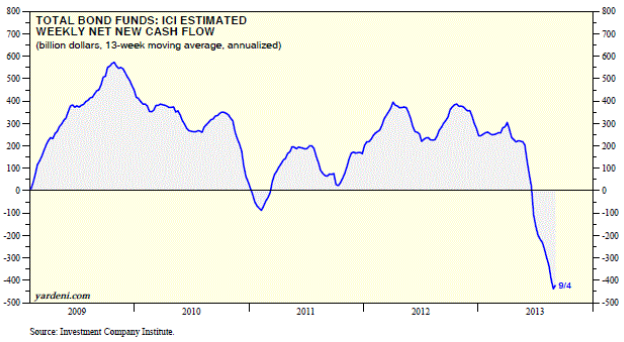

(click on image to enlarge)

Dr. Ed Yardeni, an economist both respected and practical (which makes him very rare indeed!), suggests that we may possibly be seeing the beginnings of the great rotation. He writes:

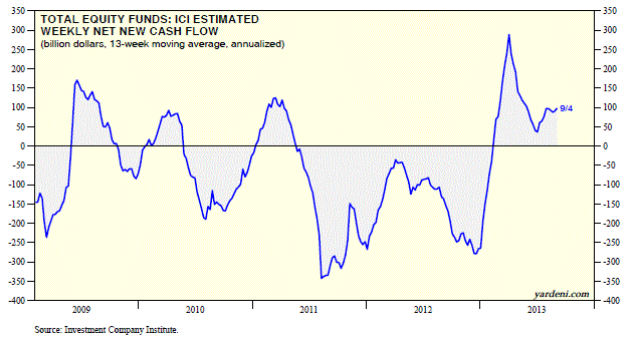

Over the past 13 weeks through the week of August 28, the Investment Company Institute estimates that bond funds had net cash outflows totaling $438 billion at an annual rate. Over the same period, equity funds had net cash inflows of $92 billion at an annual rate. I wouldn’t describe that as a “Great Rotation” just yet, but it could be the start of a big swing by retail investors into equities.

He accompanied his note with a couple of graphics that are interesting.

Things could certainly go the other way—all we really have right now are green shoots—but the implications of a great rotation could be significant.

One big reason for that is the difference in relative size of the stock and bond markets. I looked at current SIFMA data on bonds outstanding and found it was about $38.6 trillion. Total market capitalization for the Wilshire 5000, a super-broad stock index, is about $19.9 trillion right now. Stocks are only about 34% of the capital markets. The total US bond market is almost twice as large! Even money that migrates from the margin of the bond market has the potential to move the stock market quite a bit. (Global capital markets are even more lopsided, with the bond market estimated to be about 3 times larger than the equity market.)

I don’t know if we will see the great rotation going forward, but if the markets get even a whiff that we will, it could be pretty fun.