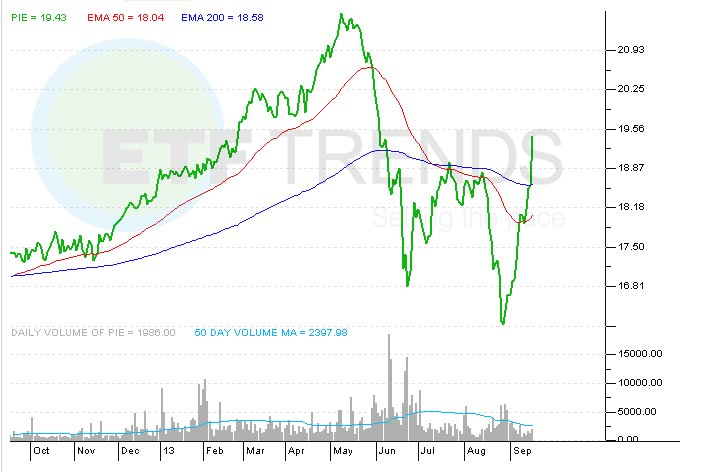

Tom Lydon covers the huge spike in PIE and other Emerging Market ETFs over the last week:

Emerging markets ETFs had been perking up for several weeks, but the group got the lift it really needed Wednesday when the Federal Reserve eschewed tapering. The U.S. central bank said its $85 billion in monthly bond purchases will remain in place and those comments could be just what the doctor ordered when it comes to confirming a significant rally for emerging markets ETFs.

There were multiple examples of the intensity with which emerging markets ETFs rallied on Wednesday. The Vanguard FTSE Emerging Markets ETF (VWO) jumped 4% while the iShares MSCI Brazil Capped ETF (EWZ) soared 5.1% and those are just two examples. With a Wednesday gain of 4.6%, the PowerShares DWA Emerging Markets Technical Leaders Portfolio (PIE) belongs on the list of emerging markets “no tapering” beneficiaries.

PIE does not follow the same cap-weighted methodology used by VWO and other larger, diversified emerging markets ETFs. Rather, PIE tracks the Dorsey Wright Emerging Markets Technical Leaders Index, which ranks its components based on relative strength traits. PIE and its index rebalance quarterly. That methodology previously helped PIE thwart larger rivals like VWO. Earlier this year when the BRIC nations were lagging, PIE was beating its rivals because it had scant BRIC exposure.

However, PIE was left vulnerable to the tapering-induced emerging markets swoon that started in earnest in May. Although PIE was not highly exposed to BRIC, the fund did have large allocations to some developing markets that waned in the face of tapering talk and higher U.S. interest rates. Think Turkey, Indonesia and Thailand as a few examples.

With tapering off the table, PIE could be in a position to thrive again. The ETF can hold stocks from the following countries: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

PowerShares DWA Emerging Markets Technical Leaders Portfolio

Past performance is no guarantee of future returns. See www.powershares.com for more information.