“I can’t buy now—the stock market is at all-time highs.” I’ve heard that, or some version of it, from multiple clients in the last few weeks. I understand where clients are coming from. Their past experience involves waiting too long to buy and then getting walloped. That’s because clients often wait for the bubble phase to invest. Not only is the stock market at all-time highs, but valuations tend to be stretched as well.

Here’s the thing: buying at all-time highs really doesn’t contain much information about whether you are making an investing mistake or not.

For proof, I will turn to a nice piece in Advisor Perspectives penned by Alliance Bernstein. Here’s what they have to say:

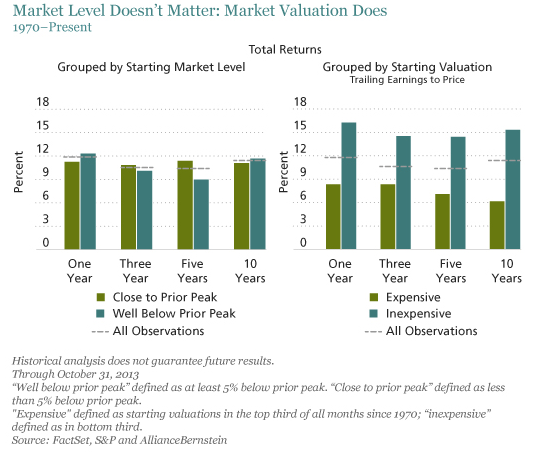

With the US stock market repeatedly reaching all-time highs in recent weeks, many investors are becoming leery of investing in stocks. Focusing on the market’s level is a mistake, in our view. It’s market valuation, not level, that matters.

Since 1900, the S&P 500 Index has been close to (within 5%) of its prior peak almost half the time. There’s a simple reason for this. The stock market goes up over time, along with the economy and corporate earnings.

Fear of investing at market peaks is understandable. In the short term, there’s always the risk that other investors will decide to take gains, or that geopolitical, economic or company-specific news will trigger a market pullback.

But for longer-term investors, market level has no predictive power. Market valuation—not market level—is what historically has mattered to future returns.

They have a nice graphic to show that investing near the high—or not near the high—is inconsequential. They show that future returns are much more correlated to valuation.

Source: Advisor Perspective (click on image to enlarge)

I’m no fundamental analyst, but commentators from Warren Buffett to Ed Yardeni to Howard Marks have suggested that valuations are reasonable, although slightly higher than average. There’s obviously no guarantee that stocks will go up, but you are probably not tap dancing on a landmine. Or let’s put it this way: if the stock market goes down from here, it won’t be because we are at all-time highs. The trend is your friend until it ends.

This post gives clear idea in support of the new visitors of blogging,

that in fact how to do running a blog.

This happens only as an exception; in some cases the family physician

will appeal to a surgeon to continue the health treatment of the patient.

If you are looking for a new opportunity in the nursing field, consider a career as a travel

nurse Travel nursing allows you to gain professional experience fast.

Trust is also a compulsory requirement for all fulfilling and happy

relationships.

Stock Market at All-Time Highs • Systematic Relative Strength • Dorsey Wright Money.

The stock market is at all-time highs, but that has very little to do with its performance going forward.