The gold market has been garnering a lot of attention lately, with prices touching multi-year lows near the $1130 level last week. Volatility really picked up last Friday, with the gold market rallying $50 after the release of the Non-Farm Payroll figures. Sharp moves like what was seen this past Friday can often have emotional effects on traders and force them out of their game plan. This is one of the main reasons that at Dorsey Wright Money Management we view a systematic based approach as a major advantage in forming a consistent process-driven approach to investing.

In the below blog post we will discuss a recent bearish pattern which was completed on the traditional point in figure chart of gold. Furthermore, we will take at particular price levels which if violated may be a sign the tide is starting to turn in favor of the bulls in the short term.

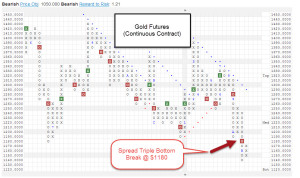

Point & Figure Chart: Gold Futures (Continuous Contract)

We previously noted that in recent weeks volatility in the gold market has picked up with large price swings in both directions being displayed on numerous occasions. One of the main advantages of using traditional point & figure chart analysis is that it aides in blocking out the so called market “noise”. In other words, buy and sell signals are produced less often due to the way the traditional point & figure charts are constructed. Remember, the key idea here is that we are attempting to spot areas of supply & demand which can help us form objective opinions on the near term direction of the market. More importantly, we can also define levels that tell us where our opinion may be wrong, which therefore allows for proper risk management! Let’s take a look at the recent developments to get a better idea of what’s been taking shape on the supply & demand front for gold.

The first major technical development to point out was the spread triple bottom break which was confirmed with the move below $1180. This had previously been a level where demand had overwhelmed supply on two previous occasions. However, on the most recent test the gold bears proved successful and the spread triple bottom was confirmed which has a measured move target of $1050.

Interesting to note the $50 reversal which occurred last Friday did reverse the chart back into a column of X’s. However, thus far the counter-trend rally has stalled out just below the $1180 level. Remember, this is the same area where our initial sell signal was given when supply overwhelmed demand and confirmed the spread triple bottom break. Another way to think about this in terms of the trading aspect would be that any of those market participants holding long futures positions from the previous demand level of $1180 are currently under water and could use this as a break-even point on existing positions, thus creating supply. Even if the gold bulls are able to force prices back above $1180, the spread triple bottom sell signal itself wouldn’t be negated until a move above $1260 was achieved.

This blog post serves as reference as to just how useful traditional point & figure charts can be in blocking out the “noise” as well as defining price levels to help develop proper risk management techniques. At Dorsey Wright, we use traditional point & figure charts in order to help us spot where pockets of relative strength among asset classes may be changing, not necessarily as buy and sell signals. Following our systematic based approach to relative strength investing has kept our exposure to markets like gold very minimal throughout much of the year.

***The relative strength strategy is not a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. The information found on Dorsey, Wright & Associates’ Web Pages has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any recommendation (express or implied) or information in this report without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis for their investment decisions. Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources, believed to be reliable. However, such information has not been verified by Dorsey, Wright and Associates, LLC (DWA) or the information provider and DWA and the information providers make no representations or warranties or take any responsibility as to the accuracy or completeness of any recommendation or information contained herein.

Neither the information nor any opinion expressed shall constitute an offer to sell or a solicitation or an offer to buy any securities or commodities mentioned herein. This report or chart does not purport to be a complete description of the securities or commodities, market or developments to which reference is made. There may be instances when fundamental, technical, and quantitative opinions may not be in concert.

Each investor should carefully consider the investment objectives, risks and expenses of any Exchange-Traded Fund (“ETF”) prior to investing. Before investing in an ETF investors should obtain and carefully read the relevant prospectus and documents the issuer has filed with the SEC. To obtain more complete information about the product the documents are publicly available for free via EDGAR on the SEC website (http://www.sec.gov).

A list of all holdings for the past 12 months is available upon request.