Some important developments for active stock pickers, from the WSJ’s Paul Vigna:

The Fed’s grip on the equities market is loosening, and that’s a good thing for stock pickers.

There’s a concept in trading called correlations, the tendency for companies that may not be alike, say, energy drillers and sneaker makers, to trade in lockstep, the stocks driven by forces beyond their control. For the past five years, with the Federal Reserve pumping trillions of fresh dollars into asset markets, correlations have been high. It was the proverbial “risk on, risk off” trade.

But with the Fed having closed down its most recent stimulus program, the bond-buying spree known as QE3, correlations among stocks have been falling away. This means that individual stocks have been trading more in line with their own fundamentals and less with the big macro trends. This offers traders, investors, and portfolio managers a chance to once again put their skills and intuitions to work, with a chance to beat the market.

“U.S. stocks are finally untethering their fortunes from the ballast supplied by the Federal Reserve over the last five years,” Nicholas Colas, the chief market strategist at New York brokerage firm Convergex, wrote in a research note Monday. The firm has been following this trend closely since the recession’s end, and found correlations hit a post-recession low in November. “The average correlation for each of the 10 industry sectors in the S&P 500 is down to 58.4% over the last month,” Nicholas Colas, ”This is by far the lowest observation we’ve seen in the last five-plus years.”

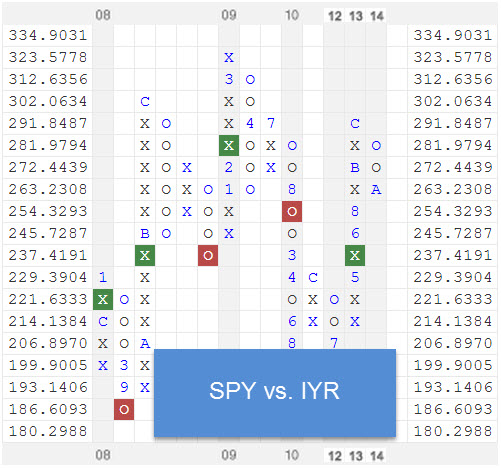

Source: Convergex

Falling correlations is music to the ears of managers employing relative strength. Lower correlations lead to greater dispersion among a given universe of stocks and potentially increases the opportunities for outperformance.

The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value.