In an ideal world, retirement planning could be simplified into the old saying “It’s not timing the market that makes all the difference, it’s time in the market.” That seems like such a prudent statement, doesn’t it? After all, timing the market conjures up images of undisciplined and emotion-driven allocation shifts in and out of the market, hopelessly trying to capture all of the up, but none of the down. Since nobody can time the market, why not just build a nicely diversified portfolio, rebalance once a year, and be done with it? Won’t that lead to fairly steady results and ultimately reaching your retirement goals? That is a nice theory, but I don’t believe that it holds up to reality. The problem with the static allocation approach, I believe, is as follow: It is not clear what the appropriate asset mix should be for a static allocation. One might look at 50 years worth of data and conclude that the static allocation should be 40% U.S. Equity, 20% International Equity, 30% Fixed Income, and 10% Commodity exposure. However, looking at 50 years worth of data is one thing. Having an appreciation for just how much variability there can be, decade to decade, in asset class returns, volatilities, and correlations can be an entirely different thing. If asset classes go through bull and bear markets, and they do, will investors have enough patience and tolerance for losses to stay the course? Some will, and over the course of 30 to 50 years, I suspect that some percentage of extremely patient clients will do just fine. However, most investors will make emotion-driven changes to their allocations. They will swear off Fixed Income in 1982. They will get bullish on Commodities in June 2008. They will give up on U.S. equities in March 2009. They will give up on European equities in 2011….and on and on. The Dalbar numbers are what they are for this very reason.

Less quantitatively, the problem with the static allocation approach can be seen in the following picture. One would like to believe that an investor could adhere to a static allocation / annual rebalance approach (“Your plan”) and steadily make progress towards your financial goals–kind of like a bank making monthly interest payments to your savings account. However, actual markets (“Reality”) are very different. Asset classes go out of favor for years, and even decades, at a time. There can be spectacular stretches of capital gains and there can be excruciatingly painful periods of market losses.

Source: @ThinkingIP

Thus, the need for a tactical approach to asset allocation. Let me be clear, I in no way advocate an undisciplined approach to asset allocation—what many think of when they think of market timing. Such an approach is very likely to perform substantially worse that the static approach to asset allocation over time. However, our research shows that relative strength can be an effective method of building an adaptive approach to asset allocation.

See: Tactical Asset Allocation Using Relative Strength, by John Lewis, CMT

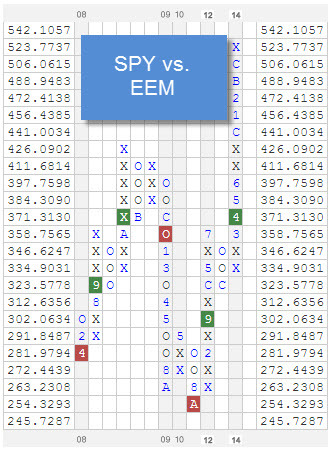

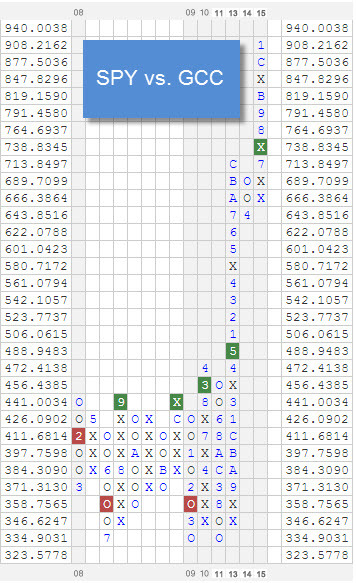

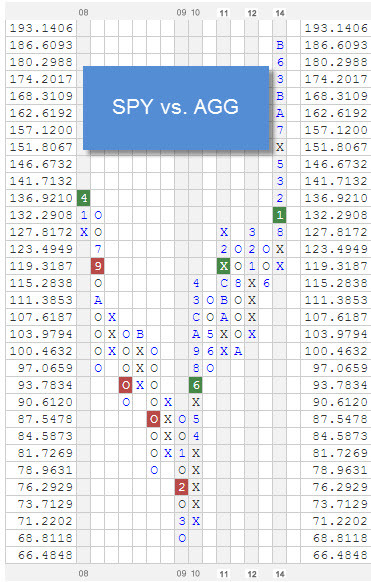

A relative strength-driven approach to asset allocation basically allows the investor the possibility of investing in multiple asset classes, but allows for great flexibility. When asset classes are relatively strong, they will receive exposure in the strategy. When they are relatively weak, they will receive little or no exposure. The exposure ranges for our Global Macro portfolio, for example, are as follows.

Global Macro is one of our most widely used approaches to asset allocation and it is available as a separately managed account, as a mutual fund, and an ETF:

- Separately Managed Account and UMA: Available on the Masters and DMA platforms at Wells Fargo Advisors and some 20 other firms. E-mail [email protected] for a fact sheet.

- Mutual Fund: Arrow DWA Tactical Fund (DWTFX). See www.arrowfunds.com

- ETF: Arrow DWA Tactical ETF (DWAT). See www. arrowshares.com

This strategy was first launched as a separately managed account on March 31, 2009. It was later adopted in the Arrow DWA Tactical Fund (DWTFX) in August 2009. Through 1/26/15, the Arrow DWA Tactical Fund (DWTFX) is stacking up quite well against its peers in the Morningstar Tactical Allocation category:

Source: Morningstar

Over the past 5 years, it has outperformed 92% of its peers; 97% of its peers over the past 3 years, 91% of its peers over the last year, and 74% of its peers so far in 2015.

Asset allocation can be flexible without being erratic and undisciplined and we believe that relative strength is the right tool for the task.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Dorsey Wright is the signal provider for the Arrow DWA Tactical Fund (DWTFX) and the Arrow DWA Tactical ETF (DWAT). See www.arrowfunds.com for a prospectus.