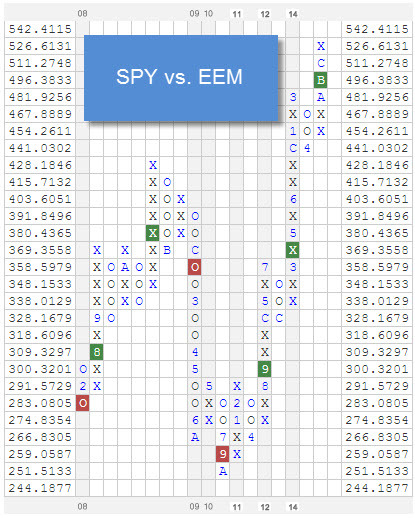

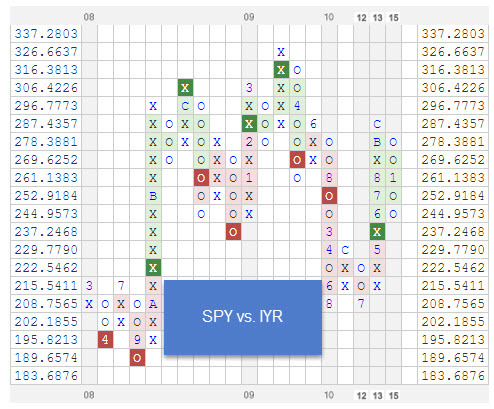

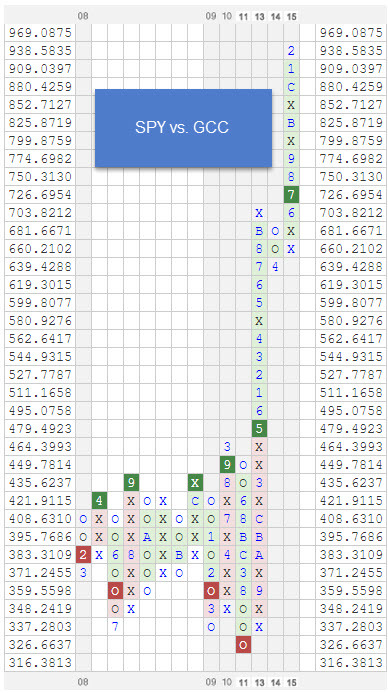

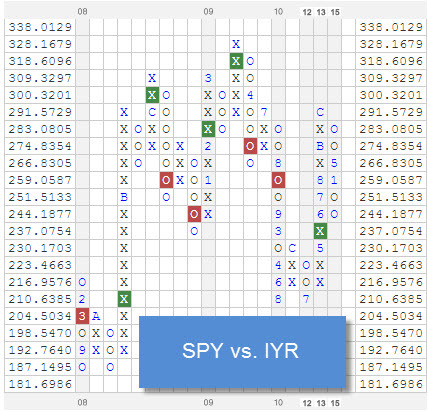

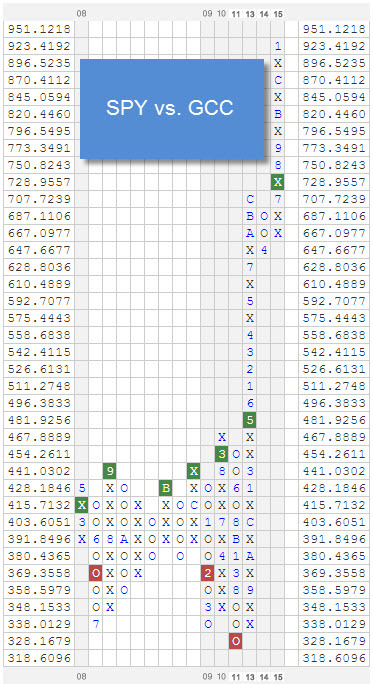

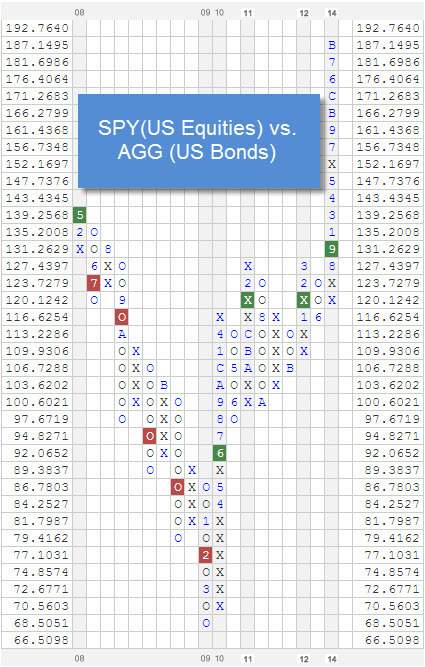

As of the close, 2/27/15:

Source: Yahoo! Finance

See www.powershares.com, www.ftportfolios.com, and www.arrowshares.com for more information.

The performance above is based on pure price returns, not inclusive of dividends or all transaction costs. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this post. It is for the general information of readers of this blog. This post does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this post, investors should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice. Dorsey Wright & Associates is the index provider for the above ETFs.