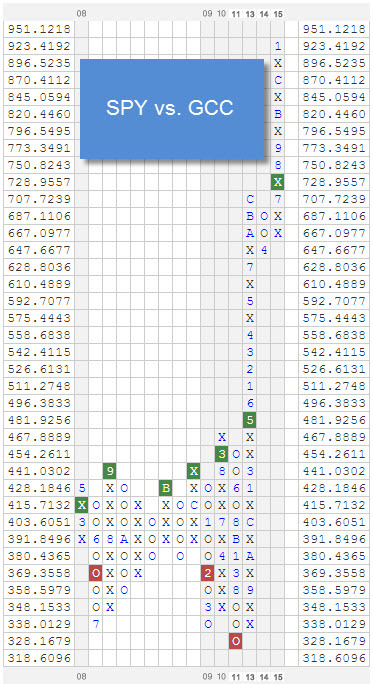

Looking at a sensitive RS chart (1% box size) shows Small Caps making a bit of a comeback against Large Caps in recent months.

a/o 2/18/15

This chart was on a RS sell signal from 4/25/14 through 2/6/2015, but is now back on a RS buy signal. The chart above covers a period of 10 years—a period that generally favored Small Caps. Once again, we are seeing signs of Small Cap strength.

With that backdrop, it might be time to take a closer look at the PowerShares DWA Small Cap Momentum ETF (DWAS). A quick review of some relevant data points for this ETF:

- Dorsey Wright is the index provider for DWAS

- DWAS began trading July, 19, 2012

- We select 200 stocks out of a universe of approximately 2,000 to be in the index

- The index is rebalanced quarterly

- To be included in this index, stocks must exhibit both near and long-term favorable PnF relative strength characteristics

- The 200 stocks in the index are weighted by momentum, thus giving a larger weight to the stocks with the best momentum in the index

- DWAS has a current score of 3.82 on the Dorsey Wright research database—an improvement of 1.72 from its score 6 months ago

Top holdings for DWAS are shown below:

Source: PowerShares

A PnF Trend Chart of DWAS is shown below:

a/o 2/19/15

DWAS made a powerful move higher in 2013, followed by a pretty rough Spring of 2014, but since then it has been chopping sideways/consolidating. Perhaps, the last year has been nothing more than a pause the refreshes in the Small Cap space.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this post. It is for the general information of readers of this blog. This post does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this post, investors should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice. Dorsey Wright & Associates is the index provider for DWAS. The Dorsey Wright SmallCap Technical Leaders Index is calculated by Dow Jones, the marketing name and a licensed trademark of CME Group Index Services LLC (“CME Indexes”). “Dow Jones Indexes” is a service mark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Products based on the Dorsey Wright SmallCap Technical Leaders Index, are not sponsored, endorsed, sold or promoted by CME Indexes, Dow Jones and their respective affiliates make no representation regarding the advisability of investing in such product(s).